Deceased Taxpayer Form

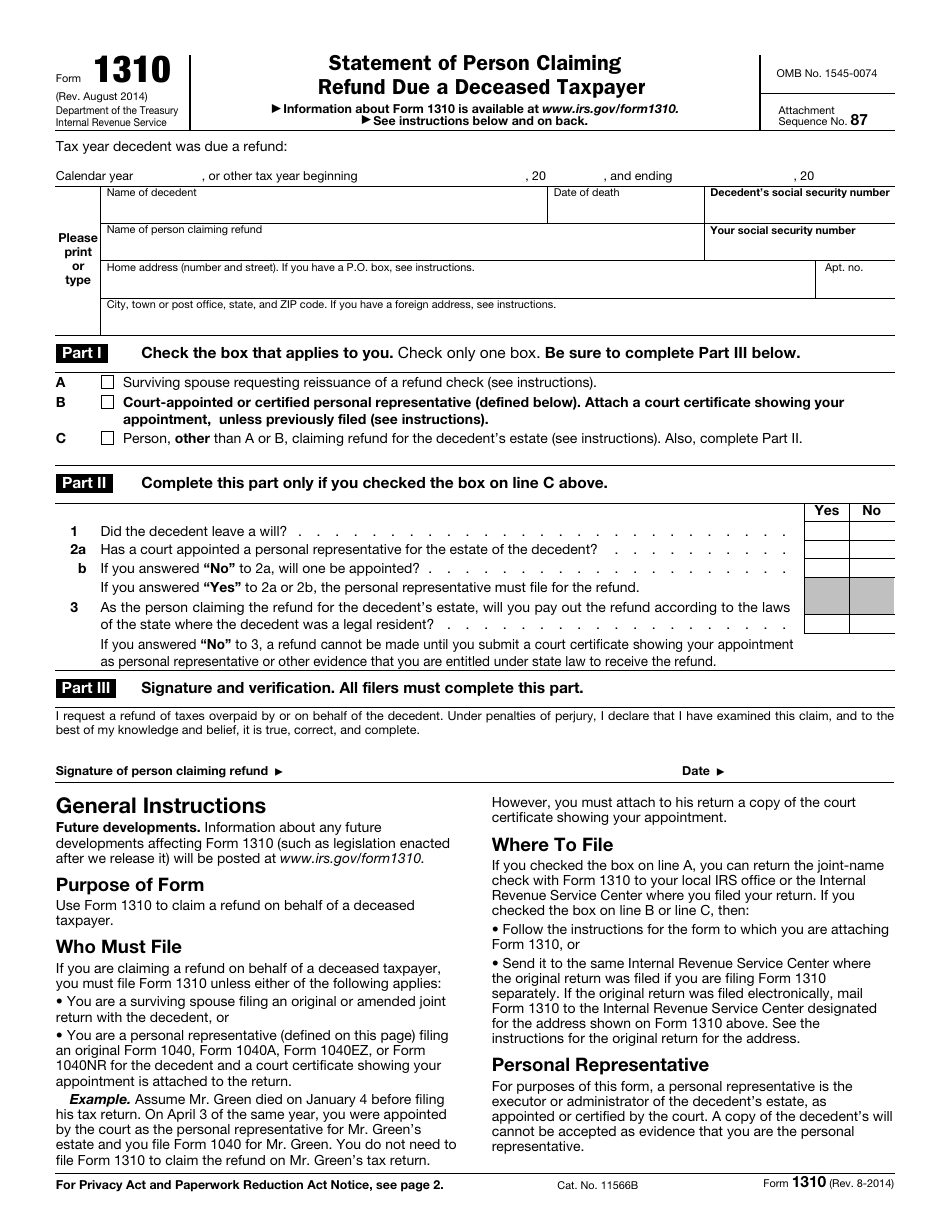

Deceased Taxpayer Form - Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. To ensure a smooth process, it’s. Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer.

Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. To ensure a smooth process, it’s. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer. To ensure a smooth process, it’s. Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer.

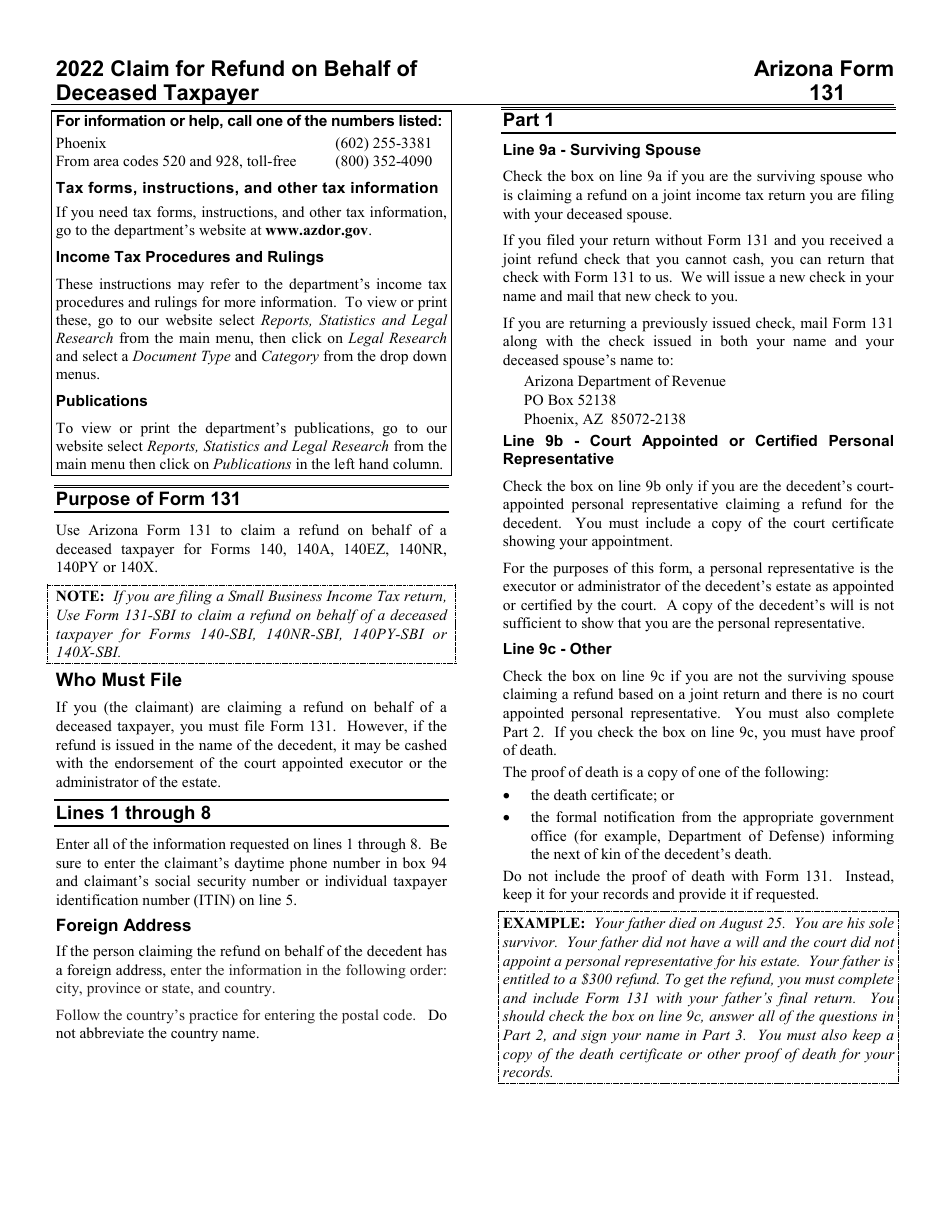

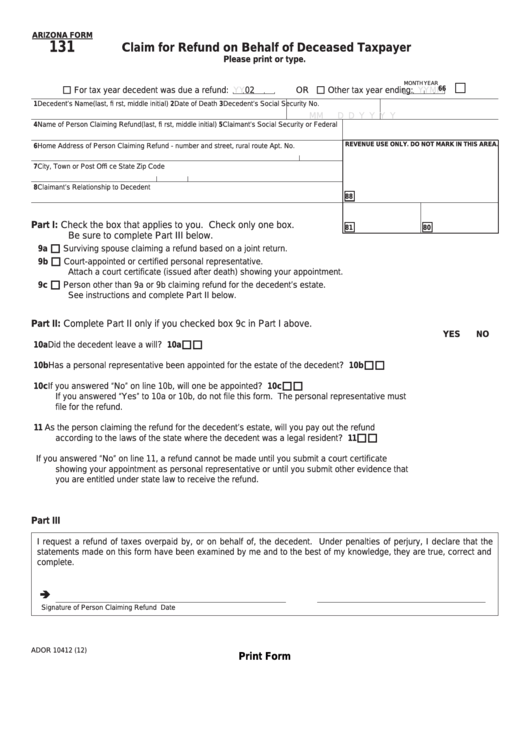

Download Instructions for Arizona Form 131, ADOR10412 Claim for Refund

You must file form 1310 if the description in line a, line b, or line c on the form. Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. To ensure a smooth process, it’s. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

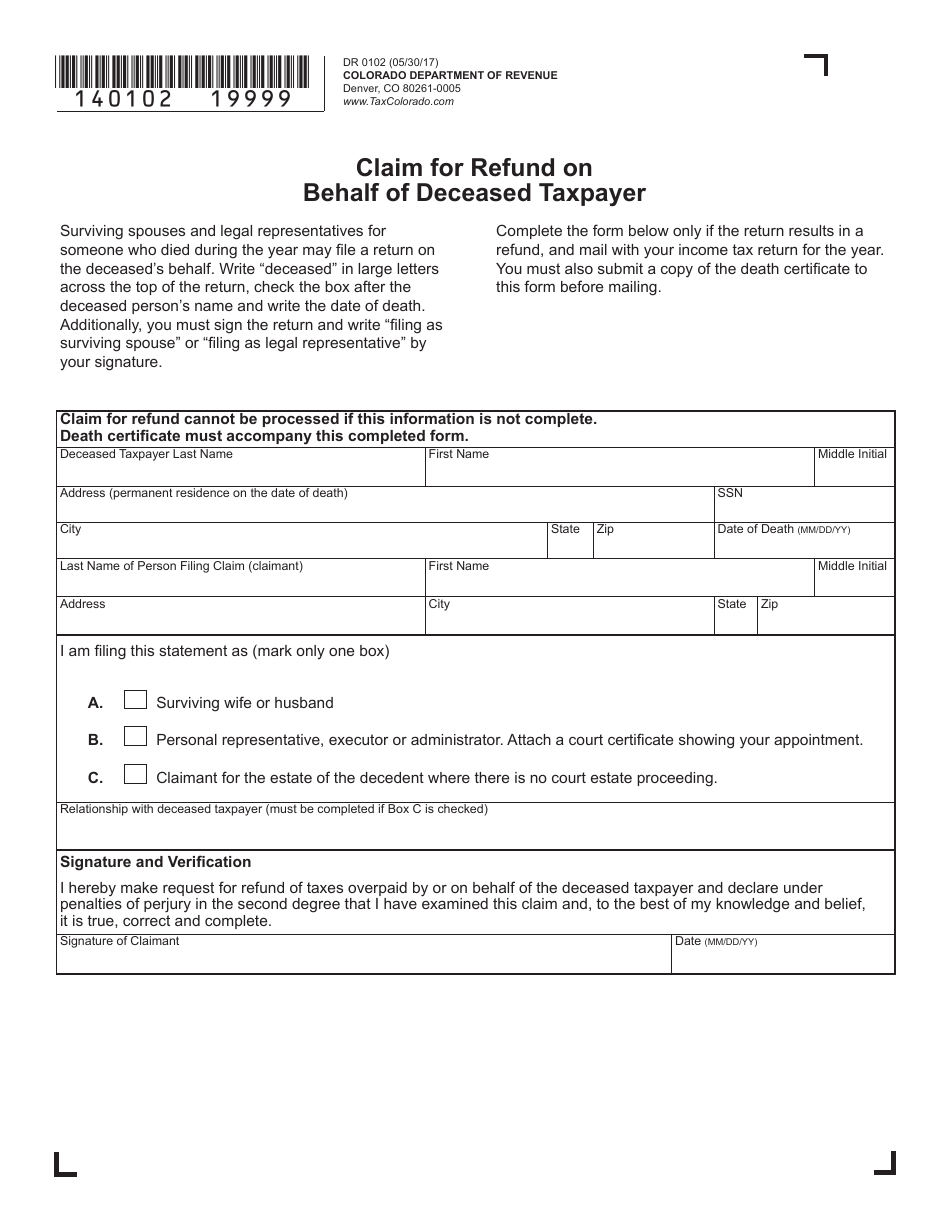

Form DR0102 Fill Out, Sign Online and Download Fillable PDF, Colorado

You must file form 1310 if the description in line a, line b, or line c on the form. To ensure a smooth process, it’s. Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

Filing the Final Return of a Deceased Person SCL Tax Services

Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. To ensure a smooth process, it’s. You must file form 1310 if the description in line a, line b, or line c on the form.

How to File IRS Form 1310 Refund Due a Deceased Taxpayer

You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. To ensure a smooth process, it’s.

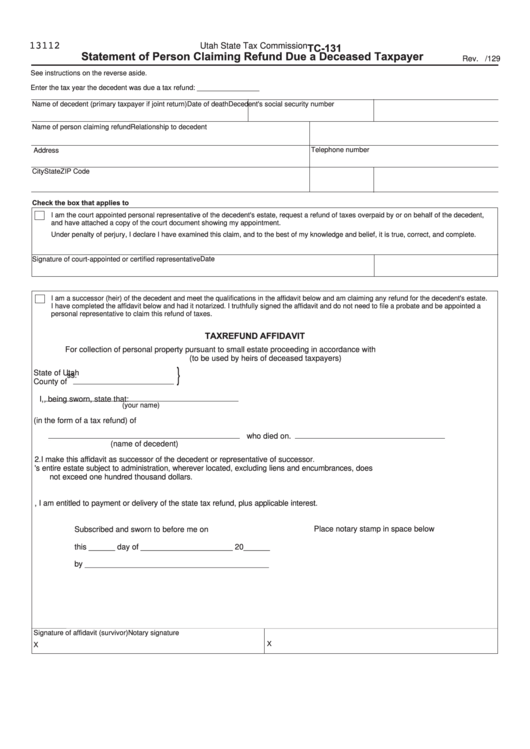

Form Tc131 Statement Of Person Claiming Refund Due A Deceased

Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. To ensure a smooth process, it’s. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

IRS Form 1310 Fill Out, Sign Online and Download Fillable PDF

You must file form 1310 if the description in line a, line b, or line c on the form. Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. To ensure a smooth process, it’s. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

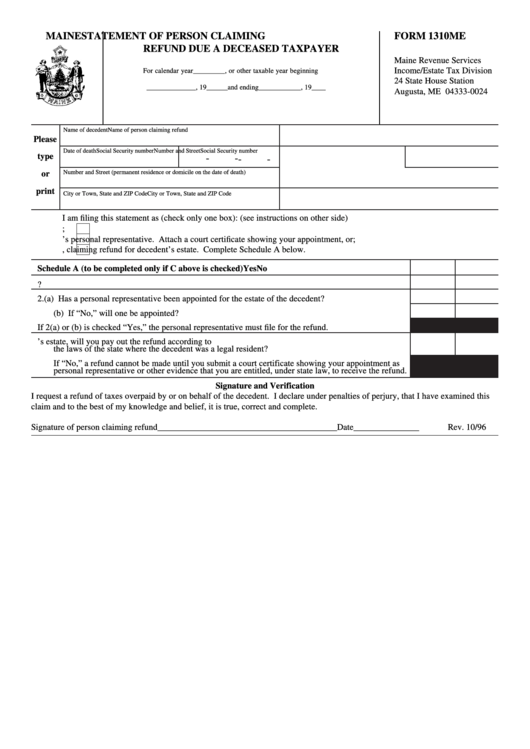

Fillable Form 1310me Statement Of Person Claiming Refund Due A

Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. To ensure a smooth process, it’s. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

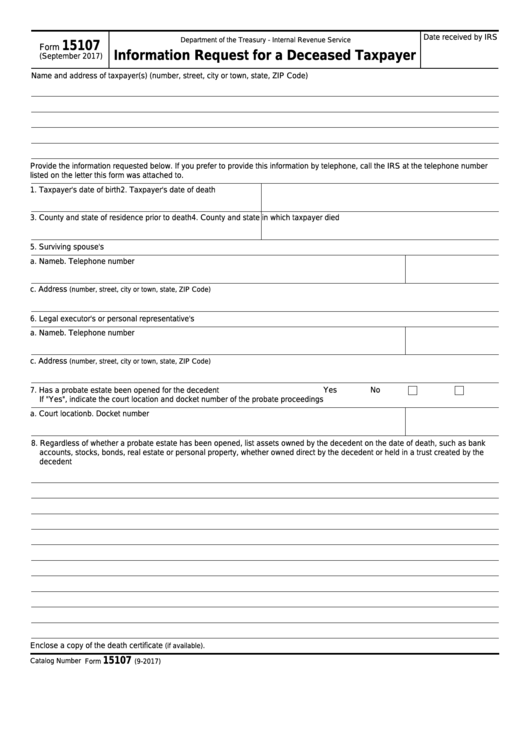

IRS Form 15107 Fill Out, Sign Online and Download Fillable PDF

Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. To ensure a smooth process, it’s. You must file form 1310 if the description in line a, line b, or line c on the form. Use form 1310 to claim a refund on behalf of a deceased taxpayer.

Fillable Form 131 Claim For Refund On Behalf Of Deceased Taxpayer

Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. You must file form 1310 if the description in line a, line b, or line c on the form. To ensure a smooth process, it’s.

Fillable Form 15107 Information Request For A Deceased Taxpayer

Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer. Use form 1310 to claim a refund on behalf of a deceased taxpayer. To ensure a smooth process, it’s. You must file form 1310 if the description in line a, line b, or line c on the form.

You Must File Form 1310 If The Description In Line A, Line B, Or Line C On The Form.

To ensure a smooth process, it’s. Use form 1310 to claim a refund on behalf of a deceased taxpayer. Form 1310 is a crucial document for filing a refund claim on behalf of a deceased taxpayer.