Ct State Tax Form

Ct State Tax Form - Simple, secure, and can be completed from the. Connecticut state department of revenue services upcoming ct drs webinar : File your 2023 connecticut income tax return online! Select to register for the upcoming withholding forms w. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Benefits to electronic filing include:

Benefits to electronic filing include: Select to register for the upcoming withholding forms w. Simple, secure, and can be completed from the. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. File your 2023 connecticut income tax return online! Connecticut state department of revenue services upcoming ct drs webinar :

File your 2023 connecticut income tax return online! Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Connecticut state department of revenue services upcoming ct drs webinar : Simple, secure, and can be completed from the. Benefits to electronic filing include: Select to register for the upcoming withholding forms w.

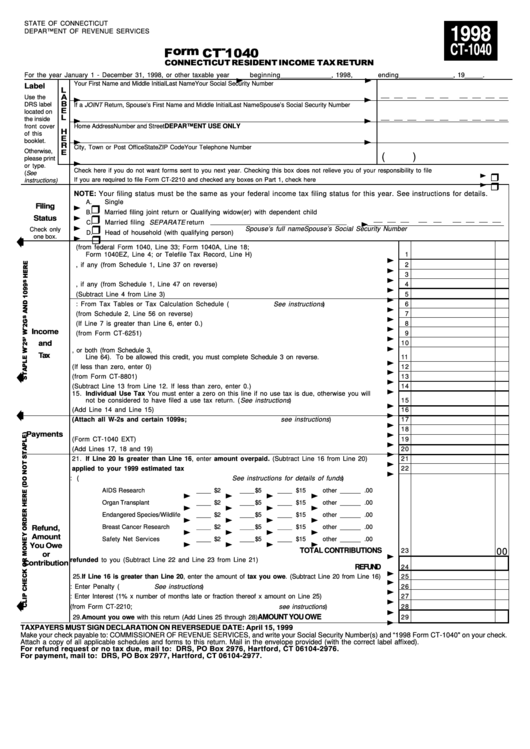

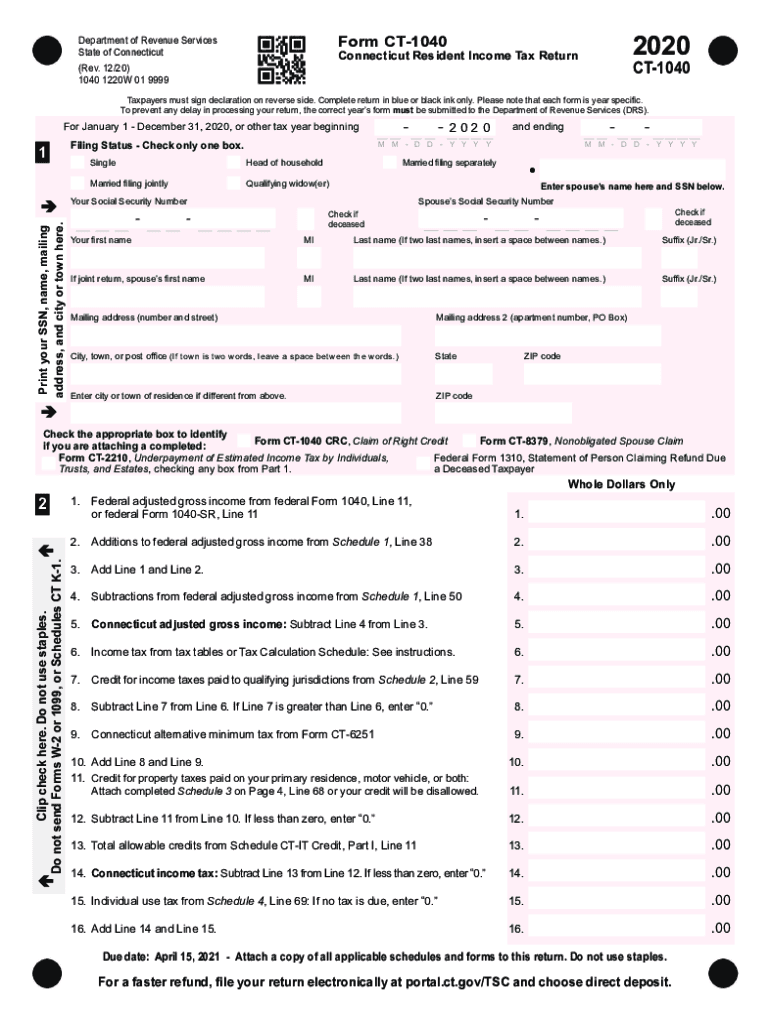

Fillable Form Ct 1040 Connecticut Resident Tax 2021 Tax Forms

Connecticut state department of revenue services upcoming ct drs webinar : Simple, secure, and can be completed from the. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Select to register for the upcoming withholding forms w. File your 2023 connecticut income tax return online!

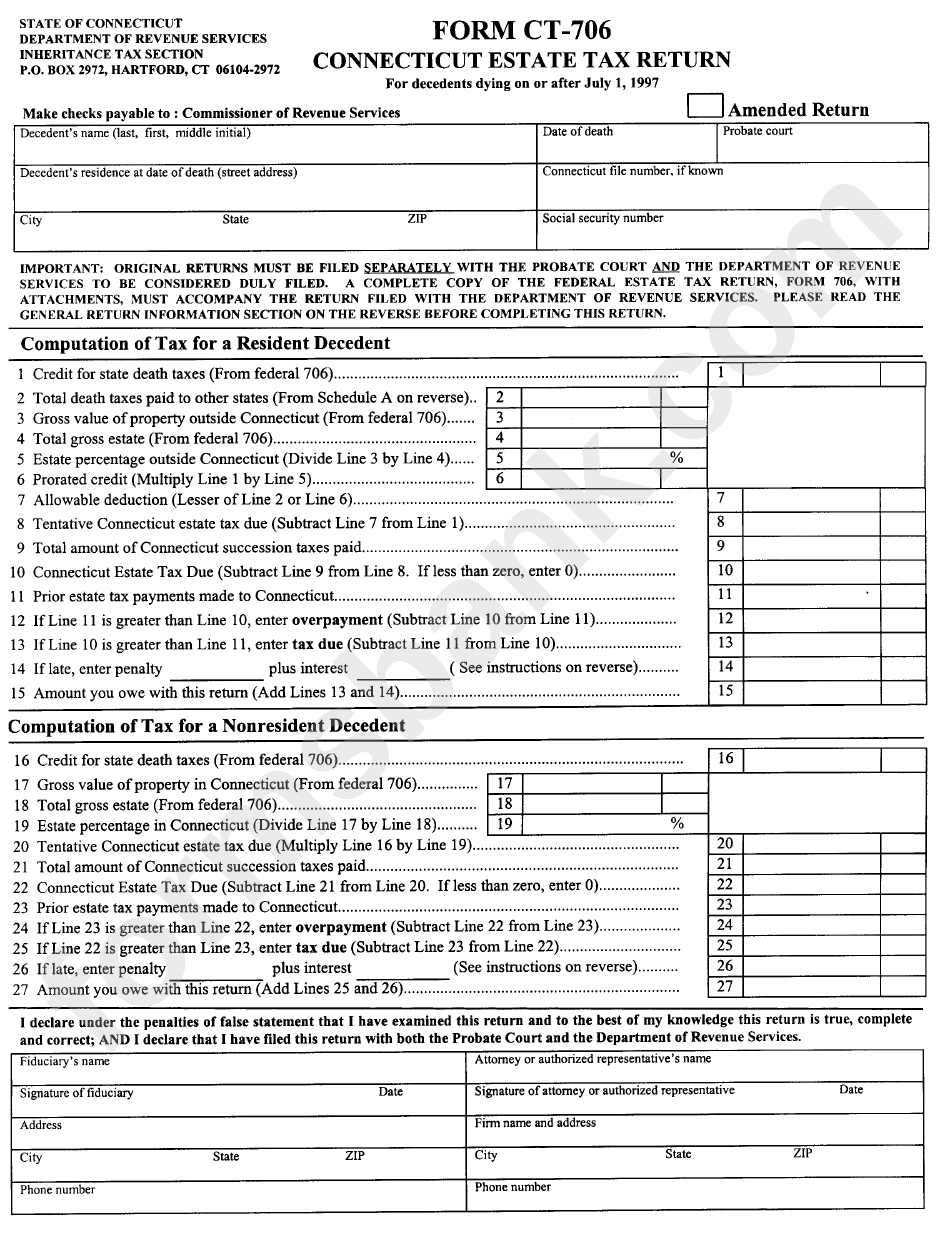

Fillable Form Ct 706 Nt Ext Printable Forms Free Online

Connecticut state department of revenue services upcoming ct drs webinar : Select to register for the upcoming withholding forms w. Simple, secure, and can be completed from the. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Benefits to electronic filing include:

Ct Drs Op 236 Fill Online, Printable, Fillable, Blank pdfFiller

Simple, secure, and can be completed from the. File your 2023 connecticut income tax return online! Select to register for the upcoming withholding forms w. Benefits to electronic filing include: Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue.

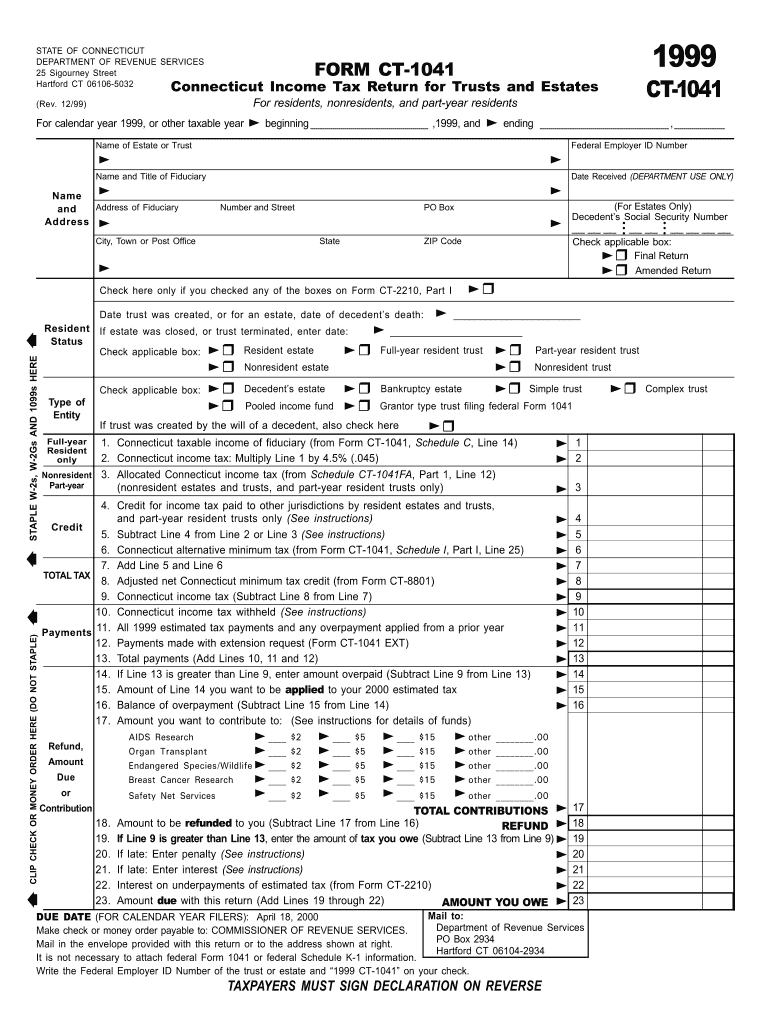

Where Do I Mail Ct 1041 airSlate SignNow

File your 2023 connecticut income tax return online! Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Simple, secure, and can be completed from the. Benefits to electronic filing include: Select to register for the upcoming withholding forms w.

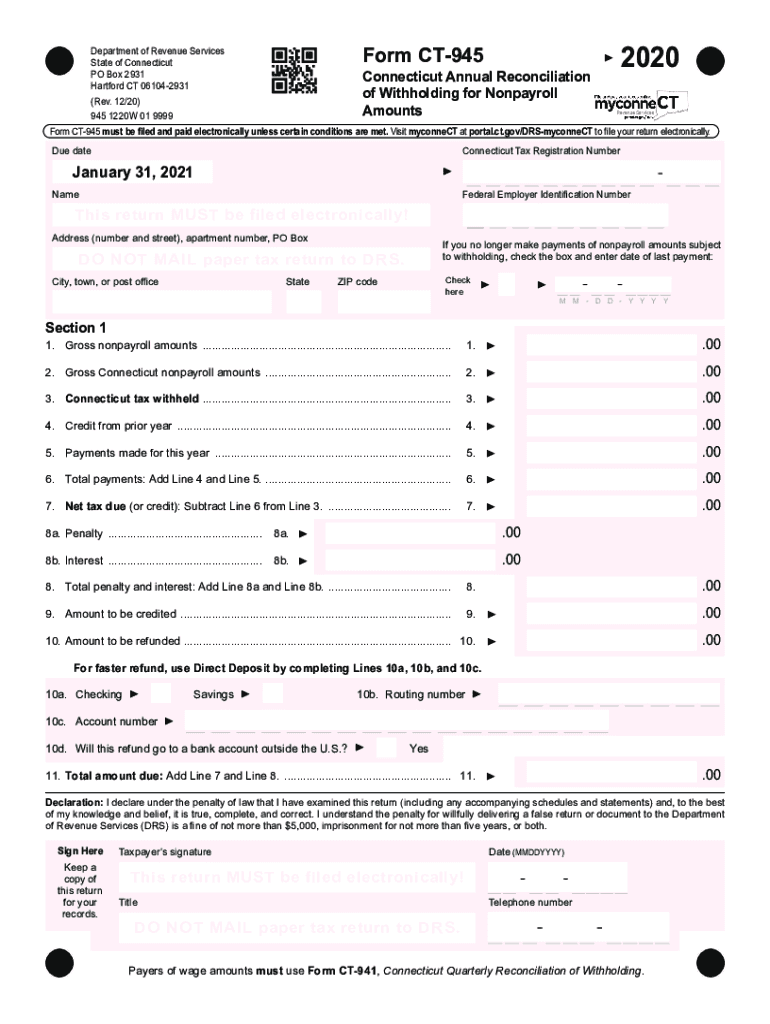

CT DRS CT945 20202022 Fill out Tax Template Online US Legal Forms

Select to register for the upcoming withholding forms w. File your 2023 connecticut income tax return online! Simple, secure, and can be completed from the. Connecticut state department of revenue services upcoming ct drs webinar : Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue.

Fillable Ct State Tax Form 1040 Printable Forms Free Online

Connecticut state department of revenue services upcoming ct drs webinar : Simple, secure, and can be completed from the. Benefits to electronic filing include: Select to register for the upcoming withholding forms w. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue.

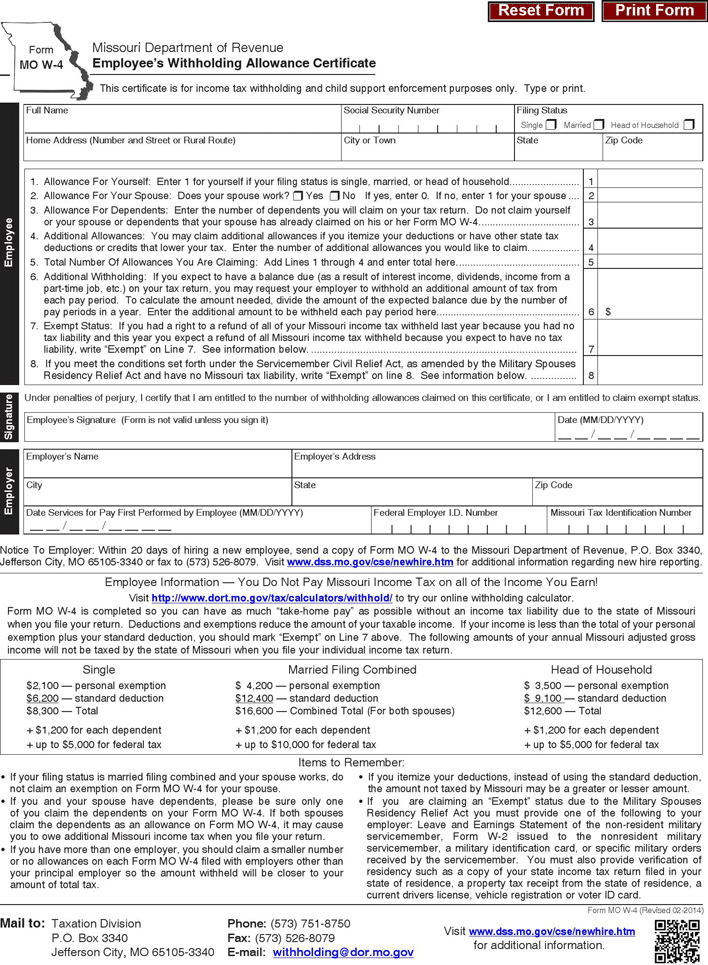

2023 Missouri W4 Form Printable Forms Free Online

Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Connecticut state department of revenue services upcoming ct drs webinar : File your 2023 connecticut income tax return online! Select to register for the upcoming withholding forms w. Benefits to electronic filing include:

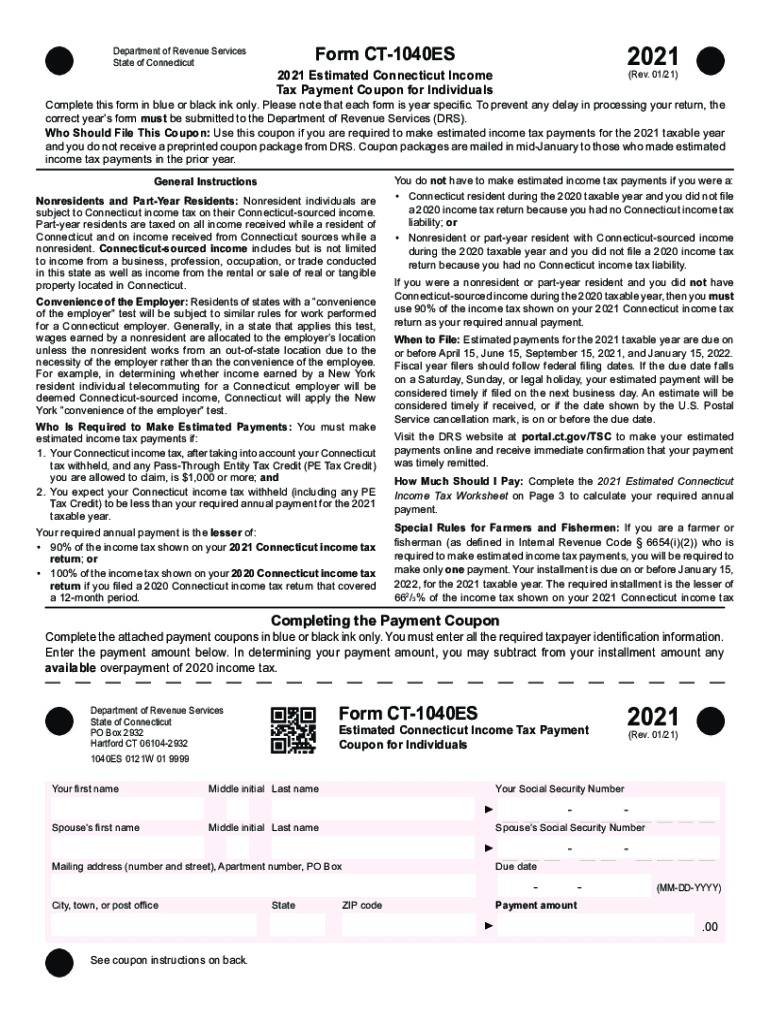

2021 Form CT DRS CT1040ES Fill Online, Printable, Fillable, Blank

Benefits to electronic filing include: Select to register for the upcoming withholding forms w. File your 2023 connecticut income tax return online! Simple, secure, and can be completed from the. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue.

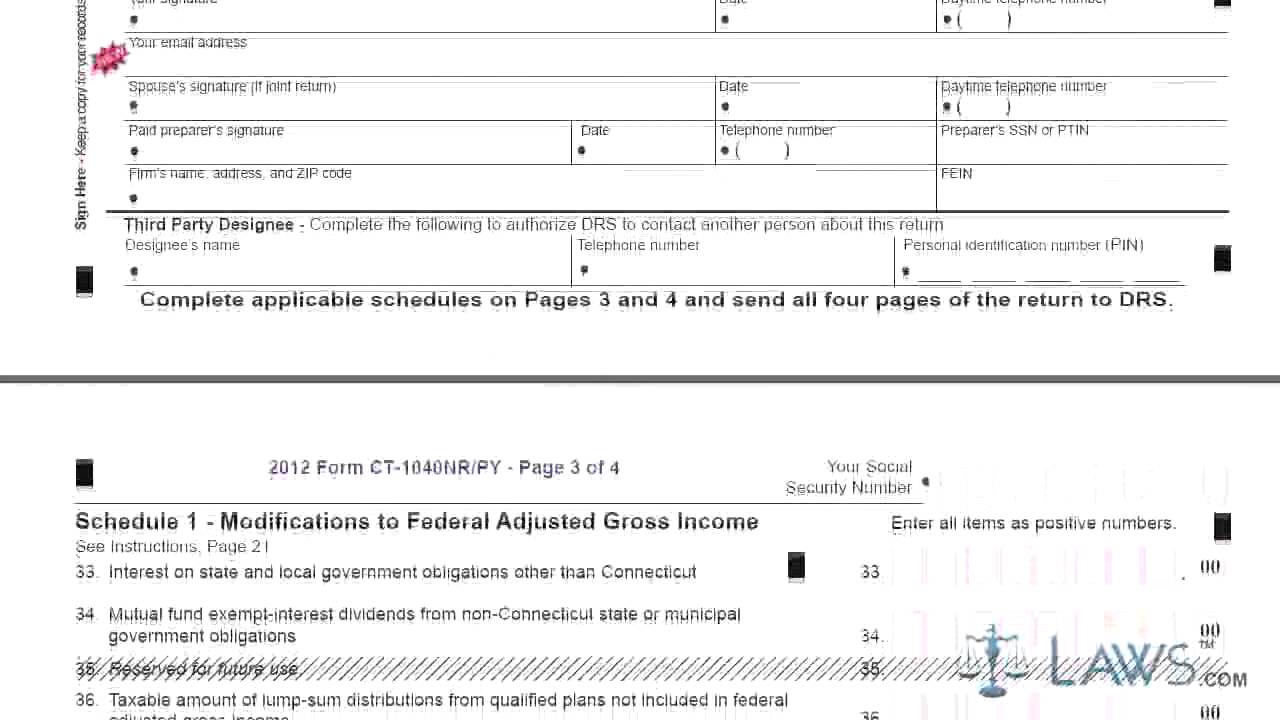

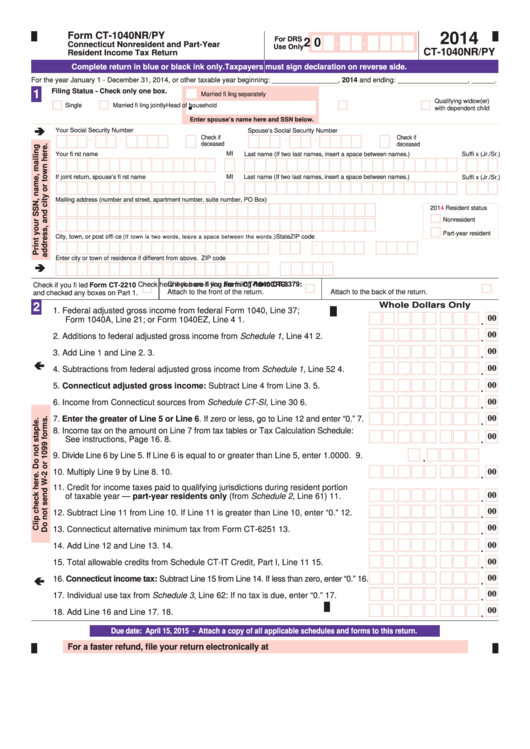

Form CT 1040NR PY Connecticut Nonresident and Part Year Resident

File your 2023 connecticut income tax return online! Simple, secure, and can be completed from the. Benefits to electronic filing include: Connecticut state department of revenue services upcoming ct drs webinar : Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue.

Fillable Form Ct1040nr/py Connecticut Nonresident And PartYear

File your 2023 connecticut income tax return online! Benefits to electronic filing include: Simple, secure, and can be completed from the. Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. Connecticut state department of revenue services upcoming ct drs webinar :

Simple, Secure, And Can Be Completed From The.

Connecticut has a state income tax that ranges between 2% and 6.99%, which is administered by the connecticut department of revenue. File your 2023 connecticut income tax return online! Connecticut state department of revenue services upcoming ct drs webinar : Benefits to electronic filing include: