Copart Multi State Tax Form

Copart Multi State Tax Form - All businesses engaging in interstate commerce should be familiar with the multistate exemption certificate, which can be used to. I further certify that if any property or service so purchased tax free is used or consumed by purchaser as to make it subject to a sales or. This multijurisdiction form has been updated as of october 14, 2022. In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. If you are entitled to sales tax exemption, please. This certificate, we are obligated to collect the tax for the state in which the property is delivered. The commission has developed a uniform sales & use tax. Documents may be uploaded using.

The commission has developed a uniform sales & use tax. All businesses engaging in interstate commerce should be familiar with the multistate exemption certificate, which can be used to. In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. I further certify that if any property or service so purchased tax free is used or consumed by purchaser as to make it subject to a sales or. This multijurisdiction form has been updated as of october 14, 2022. This certificate, we are obligated to collect the tax for the state in which the property is delivered. If you are entitled to sales tax exemption, please. Documents may be uploaded using.

The commission has developed a uniform sales & use tax. All businesses engaging in interstate commerce should be familiar with the multistate exemption certificate, which can be used to. If you are entitled to sales tax exemption, please. In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. Documents may be uploaded using. This multijurisdiction form has been updated as of october 14, 2022. I further certify that if any property or service so purchased tax free is used or consumed by purchaser as to make it subject to a sales or. This certificate, we are obligated to collect the tax for the state in which the property is delivered.

Multi State Tax Form Copart

In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. If you are entitled to sales tax exemption, please. Documents may be uploaded using. This multijurisdiction form has been updated as of october 14, 2022. This certificate, we are obligated to collect the tax for the state in which the.

MultiState Business Where to Pay Tax

The commission has developed a uniform sales & use tax. If you are entitled to sales tax exemption, please. This multijurisdiction form has been updated as of october 14, 2022. Documents may be uploaded using. This certificate, we are obligated to collect the tax for the state in which the property is delivered.

Exemption California State Tax Form 2024

All businesses engaging in interstate commerce should be familiar with the multistate exemption certificate, which can be used to. Documents may be uploaded using. In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. The commission has developed a uniform sales & use tax. If you are entitled to sales.

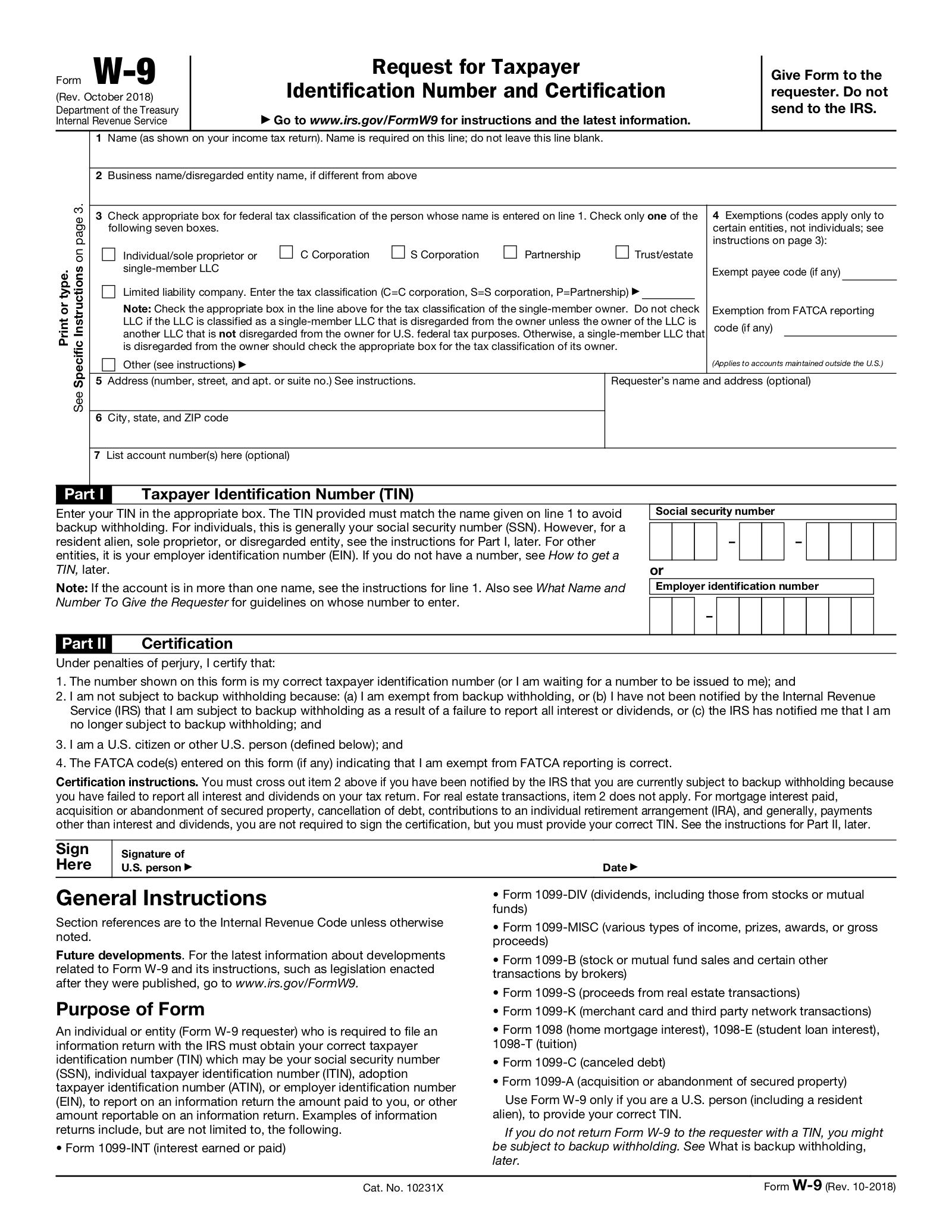

Irs W4 Form 2024 Printable Pdf Nissy Andriana

This multijurisdiction form has been updated as of october 14, 2022. This certificate, we are obligated to collect the tax for the state in which the property is delivered. In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. All businesses engaging in interstate commerce should be familiar with the.

20202024 MTC Uniform Sales & Use Tax Exemption/Resale Certificate

In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. All businesses engaging in interstate commerce should be familiar with the multistate exemption certificate, which can be used to. I further certify that if any property or service so purchased tax free is used or consumed by purchaser as to.

Denver Sales Tax Exemption Form

If you are entitled to sales tax exemption, please. I further certify that if any property or service so purchased tax free is used or consumed by purchaser as to make it subject to a sales or. In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. This multijurisdiction form.

Texas Fillable Tax Exemption Form Fill Out and Sign Printable PDF

If you are entitled to sales tax exemption, please. This multijurisdiction form has been updated as of october 14, 2022. This certificate, we are obligated to collect the tax for the state in which the property is delivered. All businesses engaging in interstate commerce should be familiar with the multistate exemption certificate, which can be used to. In california, dealers,.

Personal Tax

If you are entitled to sales tax exemption, please. The commission has developed a uniform sales & use tax. This certificate, we are obligated to collect the tax for the state in which the property is delivered. Documents may be uploaded using. In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a.

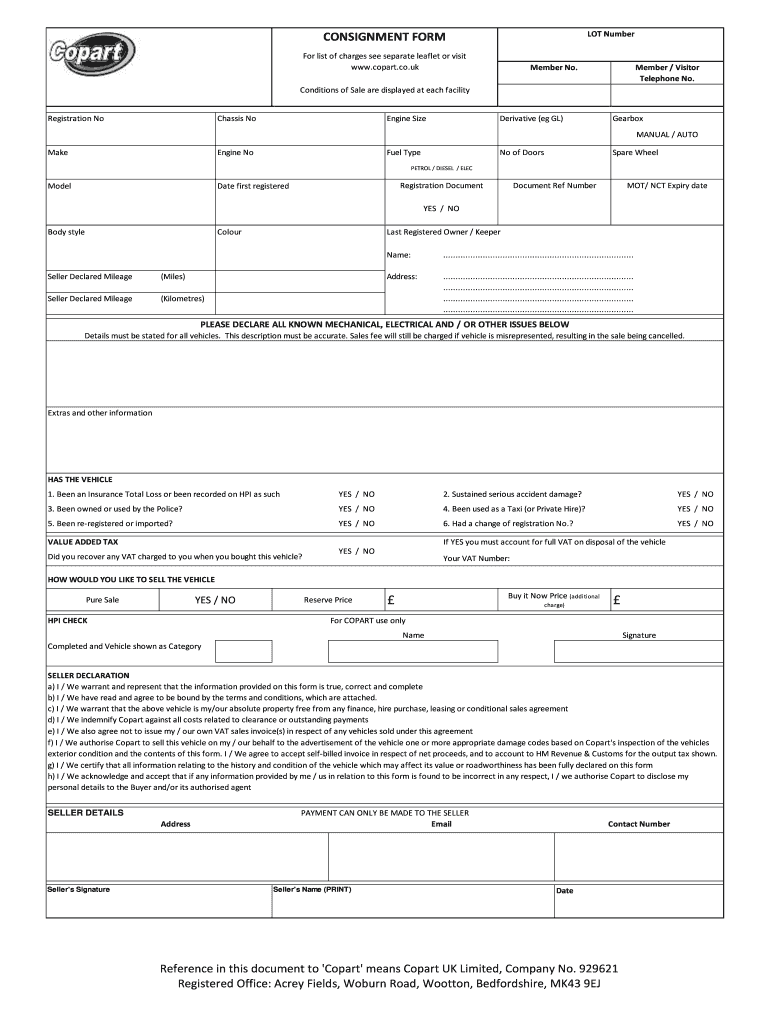

Copart Consignment Form Complete with ease airSlate SignNow

In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. All businesses engaging in interstate commerce should be familiar with the multistate exemption certificate, which can be used to. If you are entitled to sales tax exemption, please. This certificate, we are obligated to collect the tax for the state.

Uniform Sales And Use Tax Certificate Multijurisdiction 2023 Form

This multijurisdiction form has been updated as of october 14, 2022. Documents may be uploaded using. In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. The commission has developed a uniform sales & use tax. If you are entitled to sales tax exemption, please.

All Businesses Engaging In Interstate Commerce Should Be Familiar With The Multistate Exemption Certificate, Which Can Be Used To.

I further certify that if any property or service so purchased tax free is used or consumed by purchaser as to make it subject to a sales or. If you are entitled to sales tax exemption, please. The commission has developed a uniform sales & use tax. This certificate, we are obligated to collect the tax for the state in which the property is delivered.

This Multijurisdiction Form Has Been Updated As Of October 14, 2022.

In california, dealers, dismantlers, general businesses and exporters will need to provide copart an operational license and a sales tax. Documents may be uploaded using.