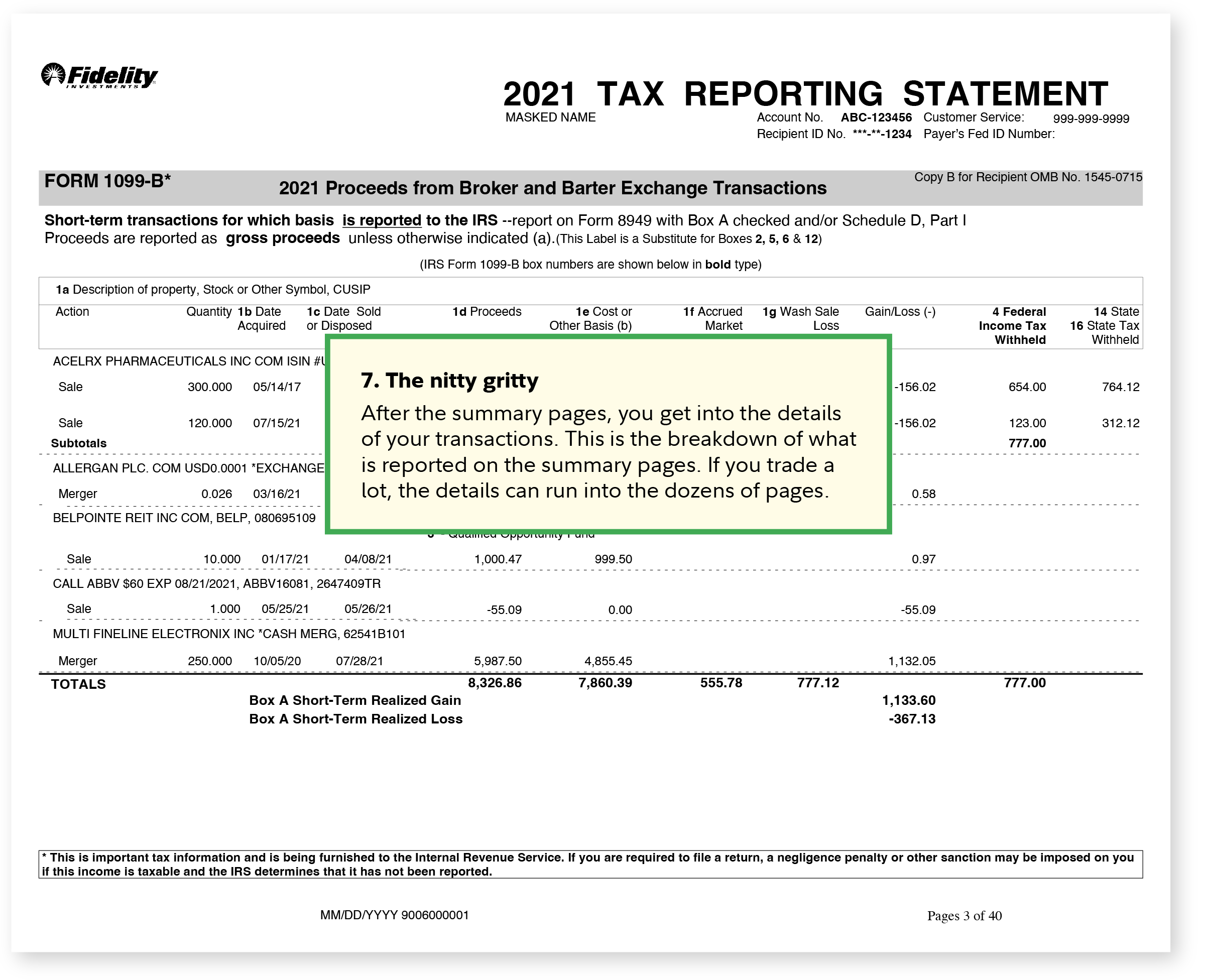

Consolidated Form 1099 Fidelity

Consolidated Form 1099 Fidelity - Your account is still pending final. But no, you don’t file the 1099 (as in, you don’t send it in). You enter it into your tax software. Pertinent info from the 1099 is already provided. Yesterday the estimated date for my fidelity 1099 changed from feb. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year.

Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year. Pertinent info from the 1099 is already provided. Your account is still pending final. But no, you don’t file the 1099 (as in, you don’t send it in). Yesterday the estimated date for my fidelity 1099 changed from feb. You enter it into your tax software.

Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year. Your account is still pending final. Yesterday the estimated date for my fidelity 1099 changed from feb. But no, you don’t file the 1099 (as in, you don’t send it in). Pertinent info from the 1099 is already provided. You enter it into your tax software.

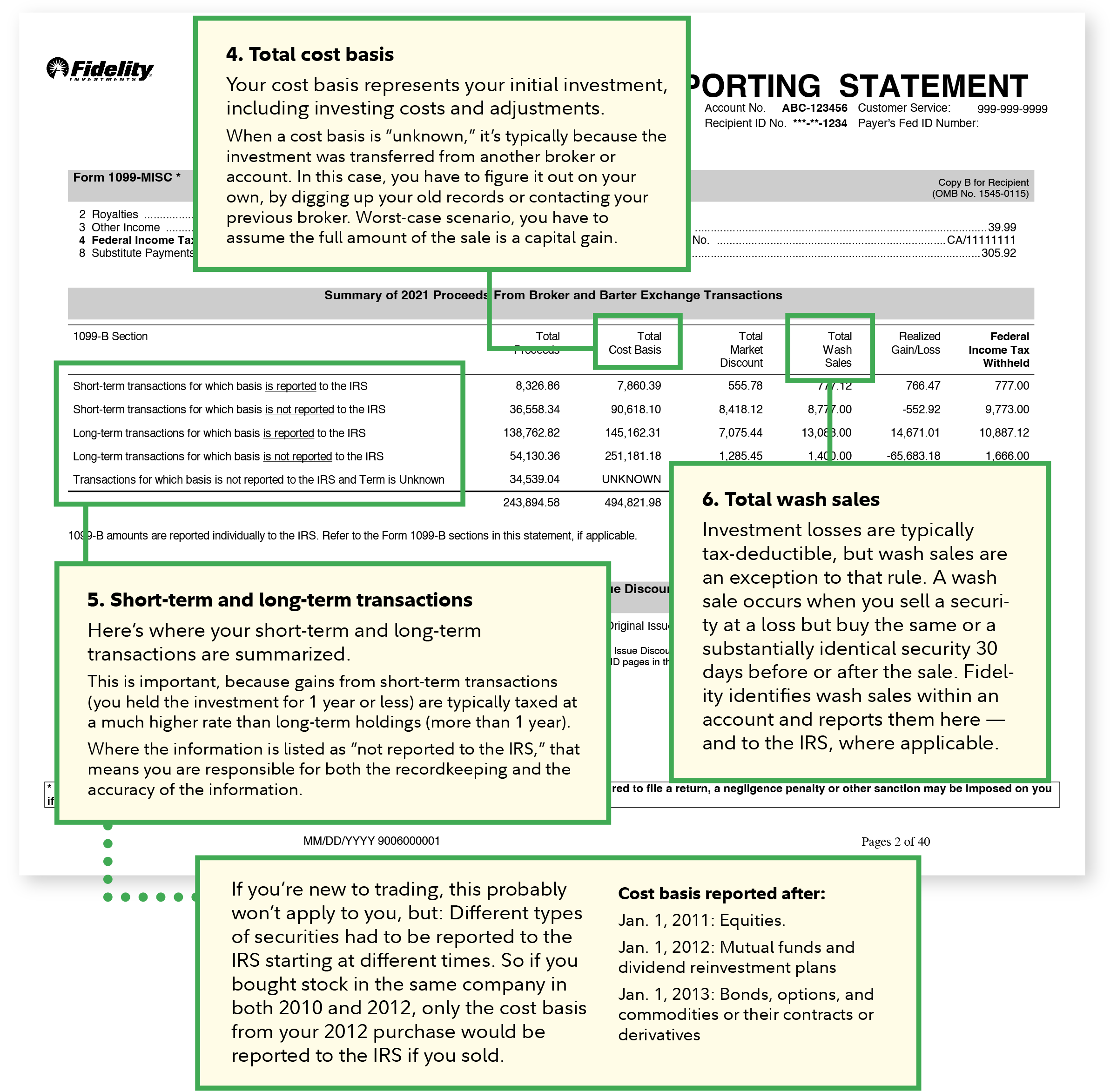

1099 tax form 1099 Fidelity (2024)

Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year. Pertinent info from the 1099 is already provided. Your account is still pending final. Yesterday the estimated date for my fidelity 1099 changed from feb. But no, you don’t file the 1099 (as in, you don’t send it.

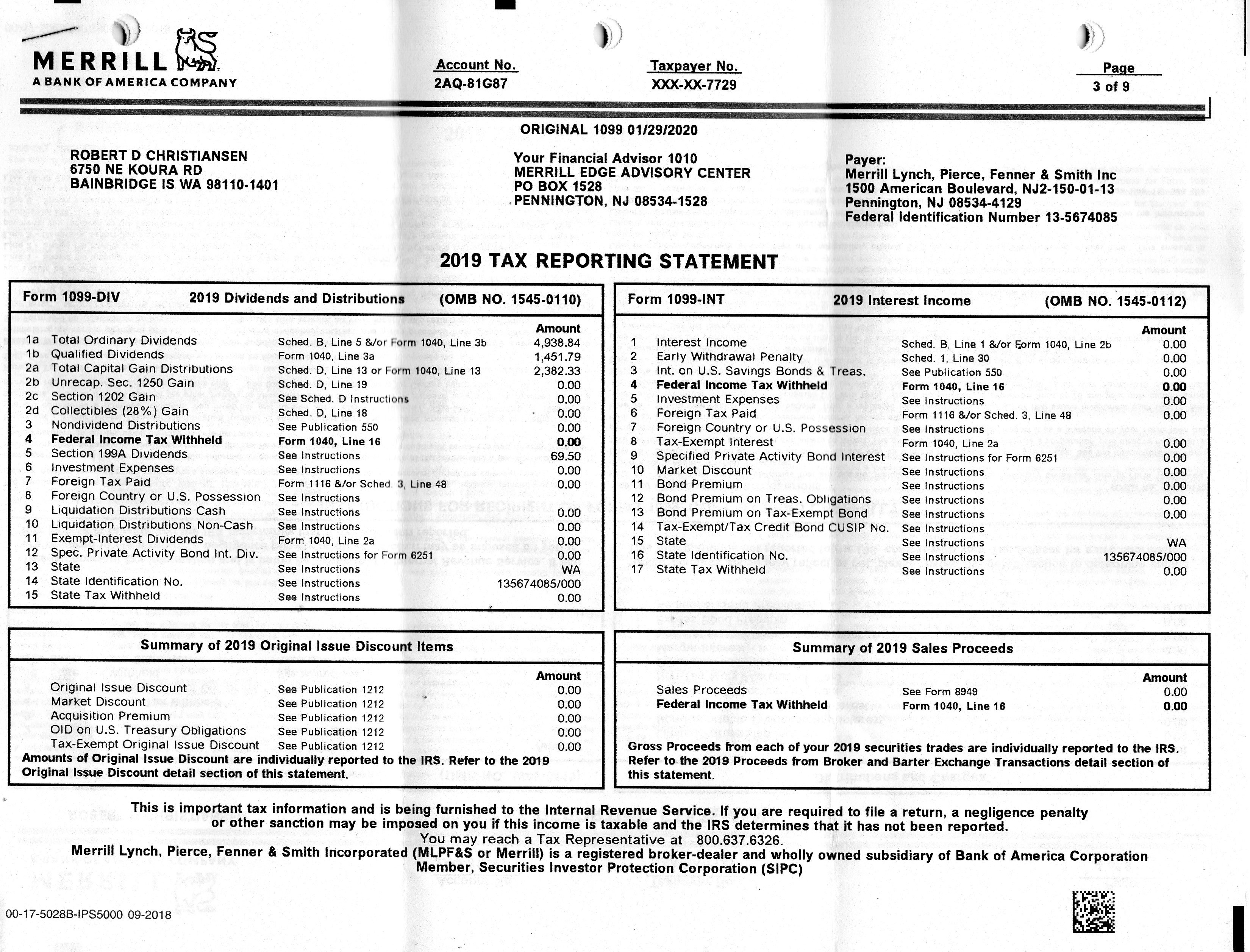

tax 2019

Yesterday the estimated date for my fidelity 1099 changed from feb. Your account is still pending final. But no, you don’t file the 1099 (as in, you don’t send it in). You enter it into your tax software. Pertinent info from the 1099 is already provided.

Consolidated Financial Statement Template Xls Template 2 Resume

But no, you don’t file the 1099 (as in, you don’t send it in). Your account is still pending final. Pertinent info from the 1099 is already provided. Yesterday the estimated date for my fidelity 1099 changed from feb. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax.

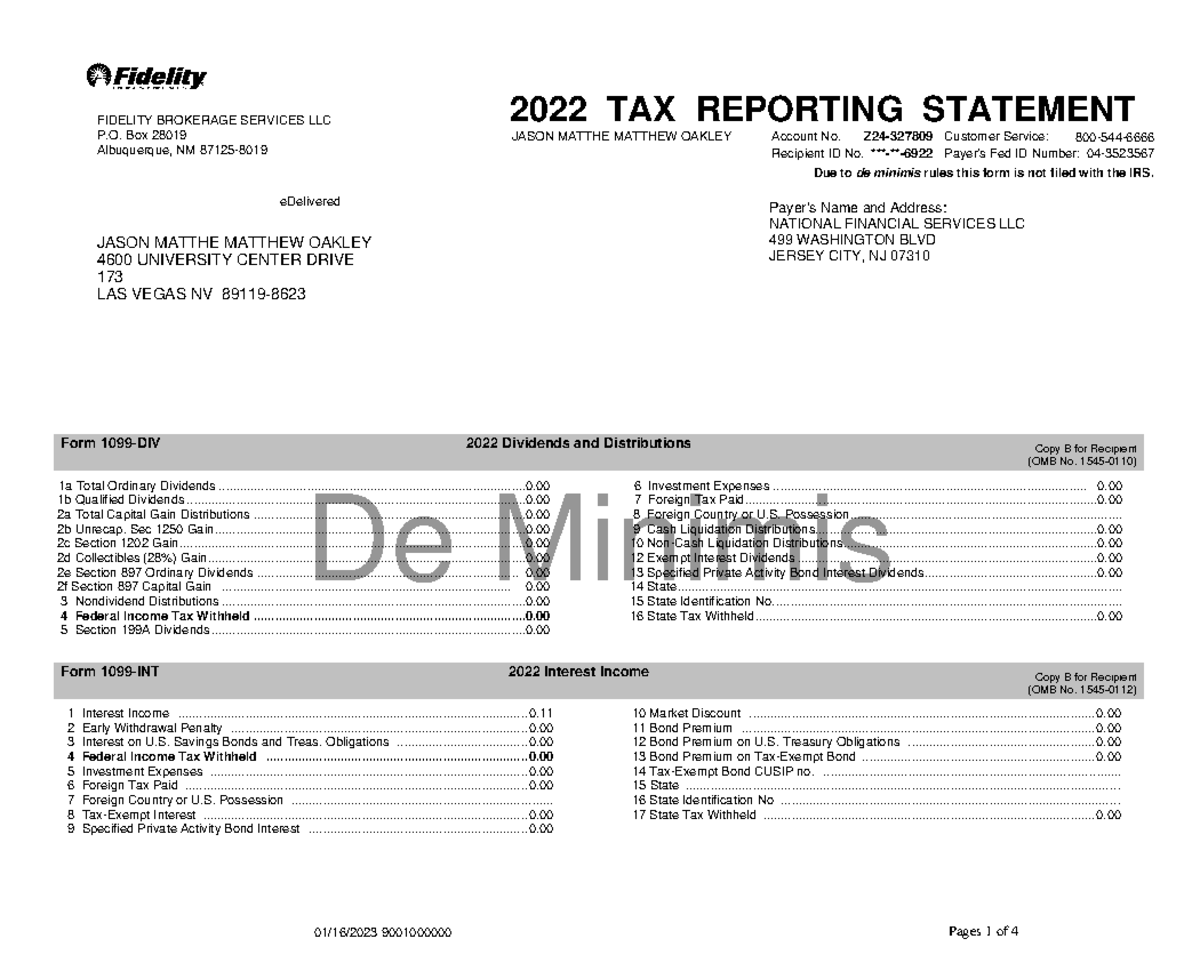

1099 Form 2022

Your account is still pending final. You enter it into your tax software. Yesterday the estimated date for my fidelity 1099 changed from feb. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year. Pertinent info from the 1099 is already provided.

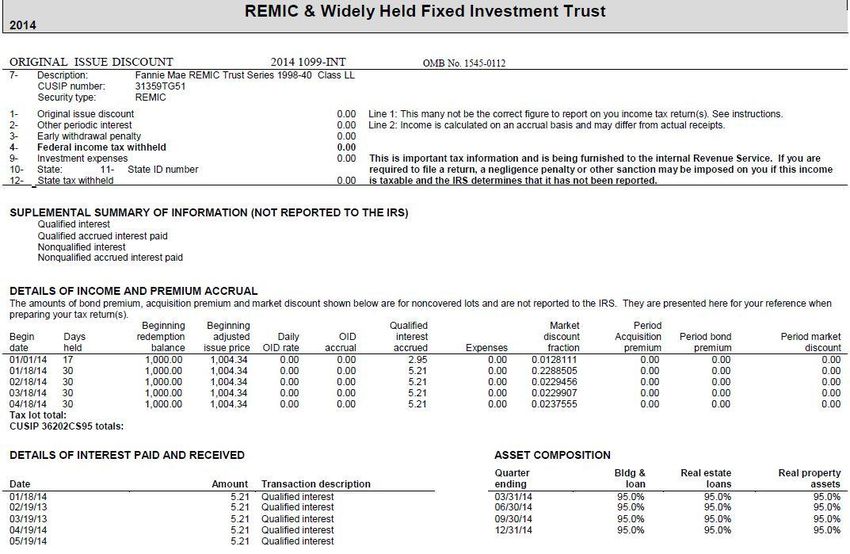

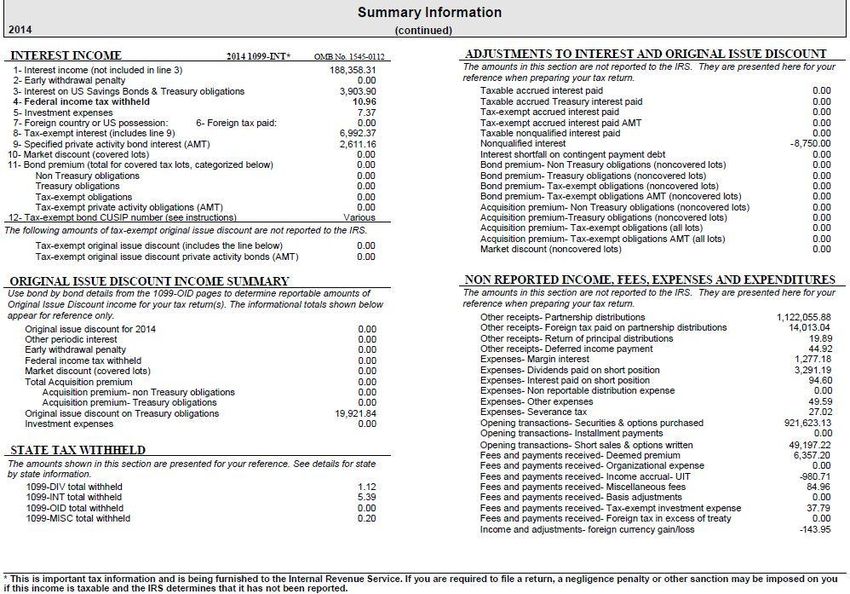

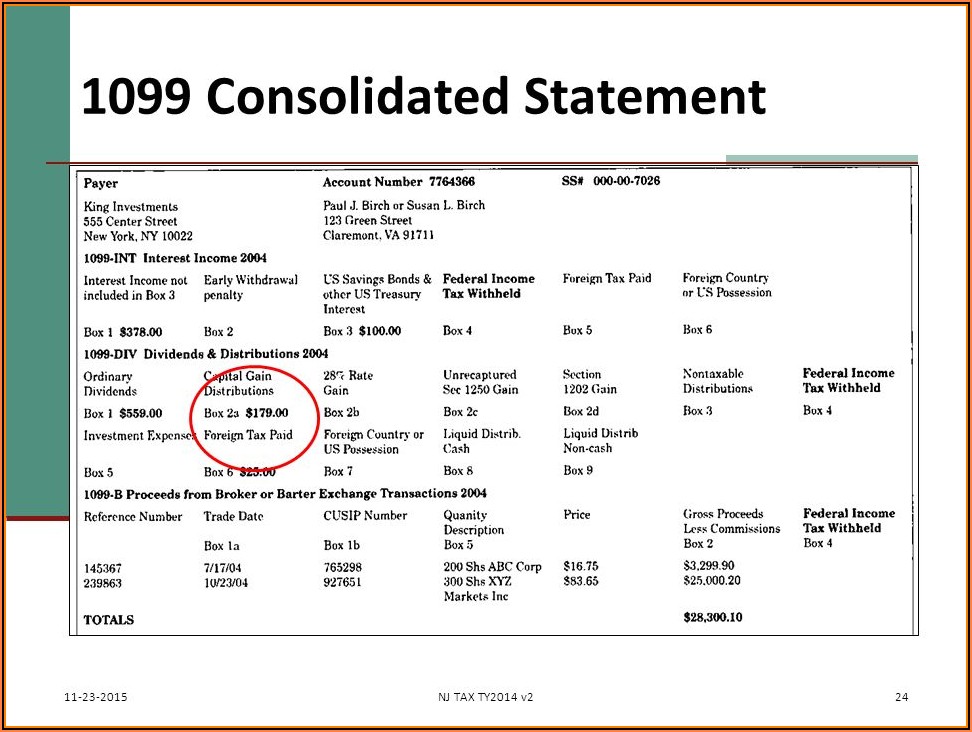

A guide to your 2014 Consolidated IRS Form 1099

You enter it into your tax software. Your account is still pending final. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year. But no, you don’t file the 1099 (as in, you don’t send it in). Pertinent info from the 1099 is already provided.

1099 tax form 1099 Fidelity (2024)

Your account is still pending final. But no, you don’t file the 1099 (as in, you don’t send it in). You enter it into your tax software. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year. Yesterday the estimated date for my fidelity 1099 changed from feb.

2022 Individual 7809 Consolidated Form 1099 Due to de minimis rules

Your account is still pending final. Pertinent info from the 1099 is already provided. Yesterday the estimated date for my fidelity 1099 changed from feb. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year. You enter it into your tax software.

A guide to your 2014 Consolidated IRS Form 1099

But no, you don’t file the 1099 (as in, you don’t send it in). Pertinent info from the 1099 is already provided. Your account is still pending final. You enter it into your tax software. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year.

1099 tax form 1099 Fidelity

Pertinent info from the 1099 is already provided. But no, you don’t file the 1099 (as in, you don’t send it in). Your account is still pending final. Yesterday the estimated date for my fidelity 1099 changed from feb. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax.

美國報稅實務常見且必須申報的 10張1099稅表 (1099Misc, 1099NEC)

Yesterday the estimated date for my fidelity 1099 changed from feb. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year. Your account is still pending final. You enter it into your tax software. But no, you don’t file the 1099 (as in, you don’t send it in).

But No, You Don’t File The 1099 (As In, You Don’t Send It In).

You enter it into your tax software. Your account is still pending final. Yesterday the estimated date for my fidelity 1099 changed from feb. Generally, the 1099 tax form will be generated for accounts that have had a reportable event occur within the given tax year.

:max_bytes(150000):strip_icc()/1099-R2022-2372bb9e77514c4a8af4bcc393b6cd36.jpeg)