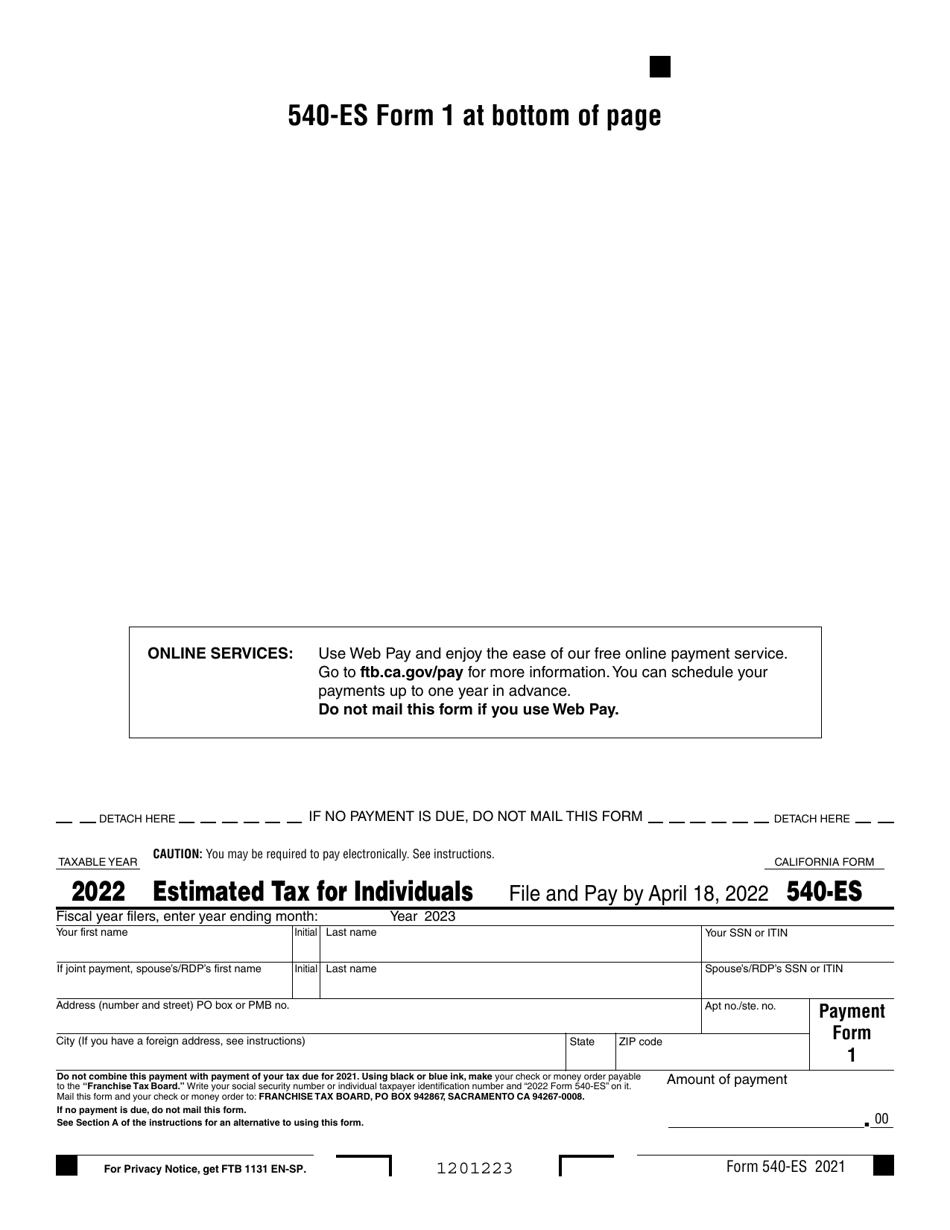

California Estimated Tax Payments Form

California Estimated Tax Payments Form - Go to ftb.ca.gov/pay for more information. Estimated tax is used to. Use web pay and enjoy the ease of our free online payment service. You can schedule your payments. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Estimated tax is used to. Go to ftb.ca.gov/pay for more information. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. You can schedule your payments. Use web pay and enjoy the ease of our free online payment service.

You can schedule your payments. Use web pay and enjoy the ease of our free online payment service. Go to ftb.ca.gov/pay for more information. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to.

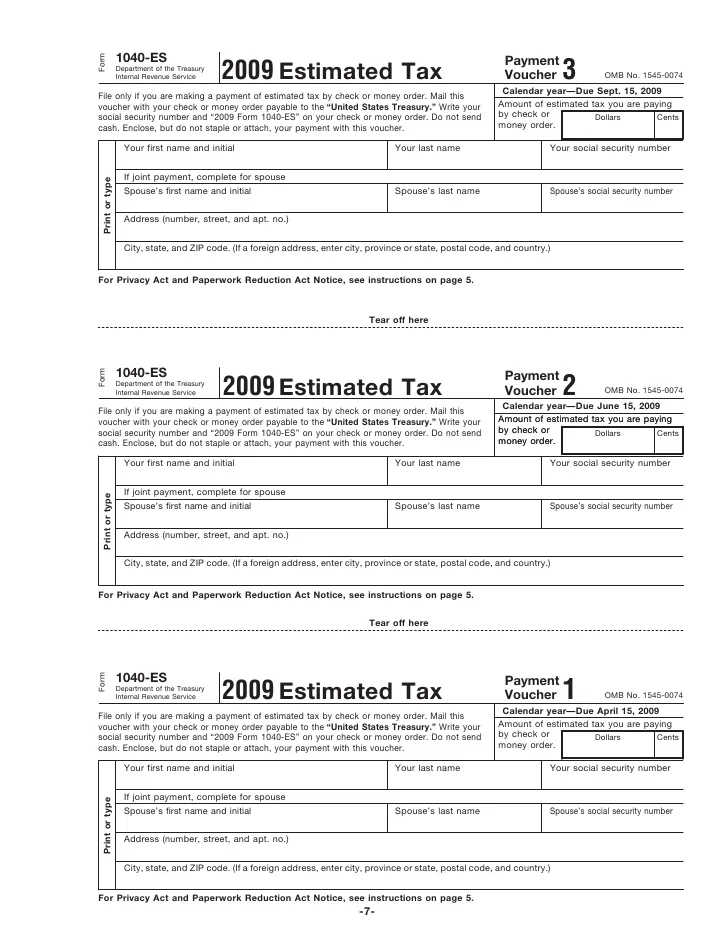

How to Calculate & Determine Your Estimated Taxes Form 1040ES

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use web pay and enjoy the ease of our free online payment service. Go to ftb.ca.gov/pay for more information. You can schedule your payments. Estimated tax is used to.

Form 540ES Download Fillable PDF or Fill Online Estimated Tax for

You can schedule your payments. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Go to ftb.ca.gov/pay for more information. Use web pay and enjoy the ease of our free online payment service.

California Estimated Tax Payments 2024 Online Anissa Cynthia

Go to ftb.ca.gov/pay for more information. You can schedule your payments. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use web pay and enjoy the ease of our free online payment service. Estimated tax is used to.

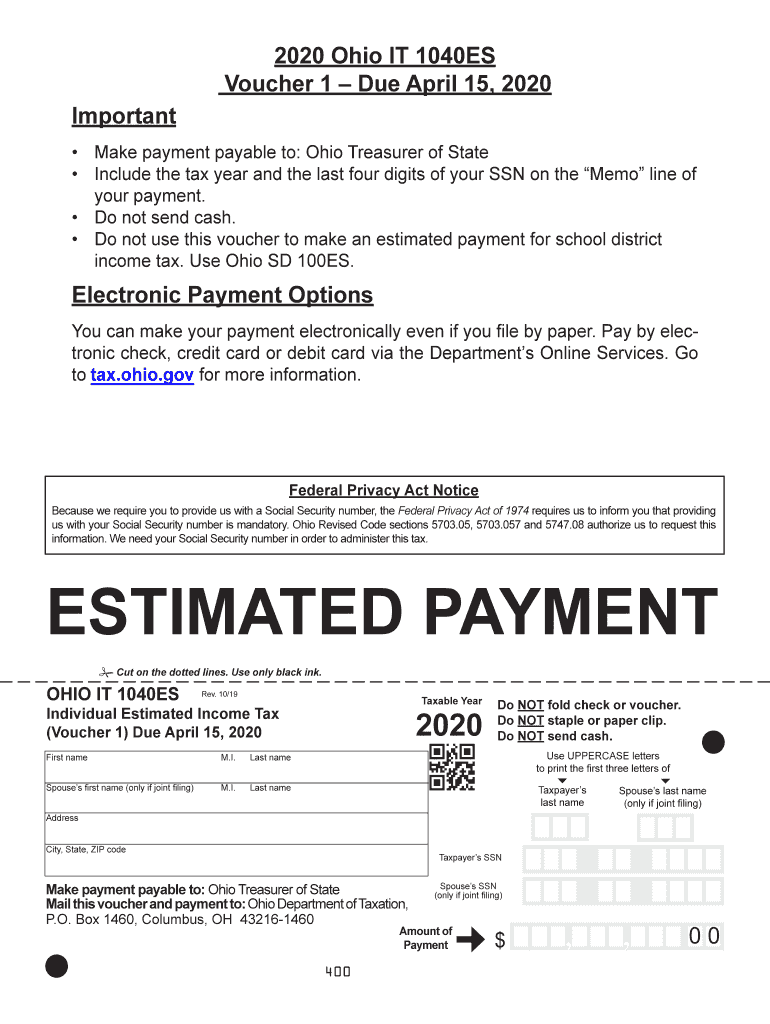

Oh Estimated 20202024 Form Fill Out and Sign Printable PDF Template

Go to ftb.ca.gov/pay for more information. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use web pay and enjoy the ease of our free online payment service. You can schedule your payments.

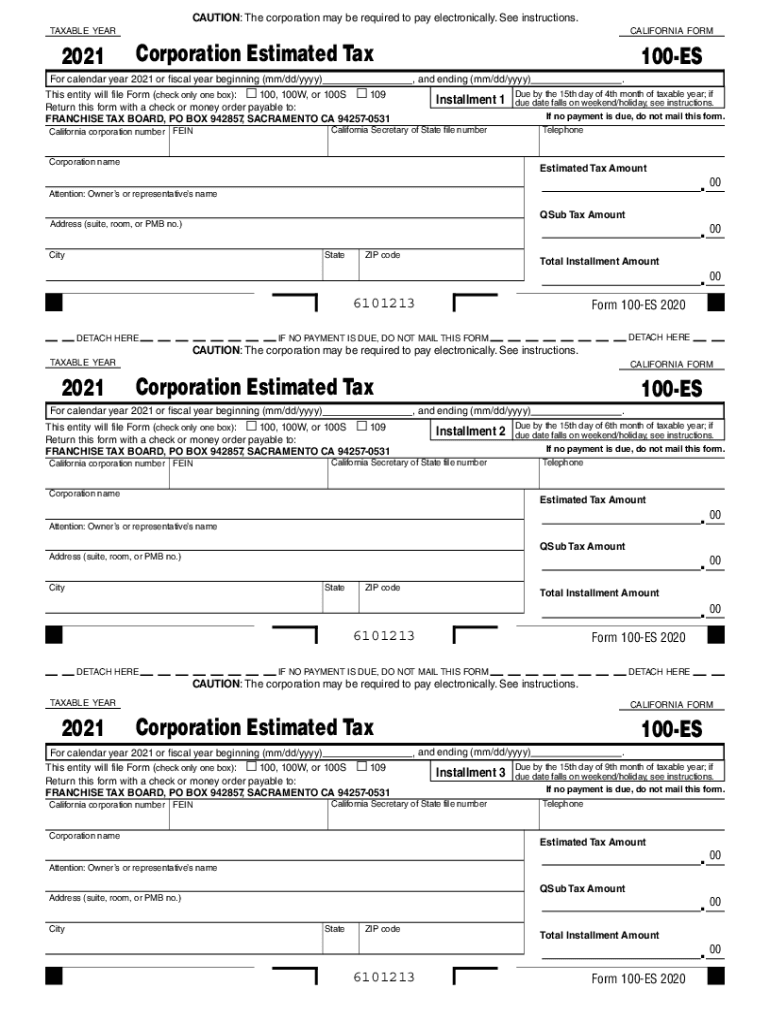

2021 California Estimated Tax Worksheet

Estimated tax is used to. Use web pay and enjoy the ease of our free online payment service. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Go to ftb.ca.gov/pay for more information. You can schedule your payments.

Estimated Tax Payments 2024 California Tax Eddi Nellie

Use web pay and enjoy the ease of our free online payment service. Estimated tax is used to. Go to ftb.ca.gov/pay for more information. You can schedule your payments. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

California Estimated Tax Worksheet 2024

Use web pay and enjoy the ease of our free online payment service. You can schedule your payments. Go to ftb.ca.gov/pay for more information. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to.

Reducing Estimated Tax Penalties With IRA Distributions

Go to ftb.ca.gov/pay for more information. Estimated tax is used to. Use web pay and enjoy the ease of our free online payment service. You can schedule your payments. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

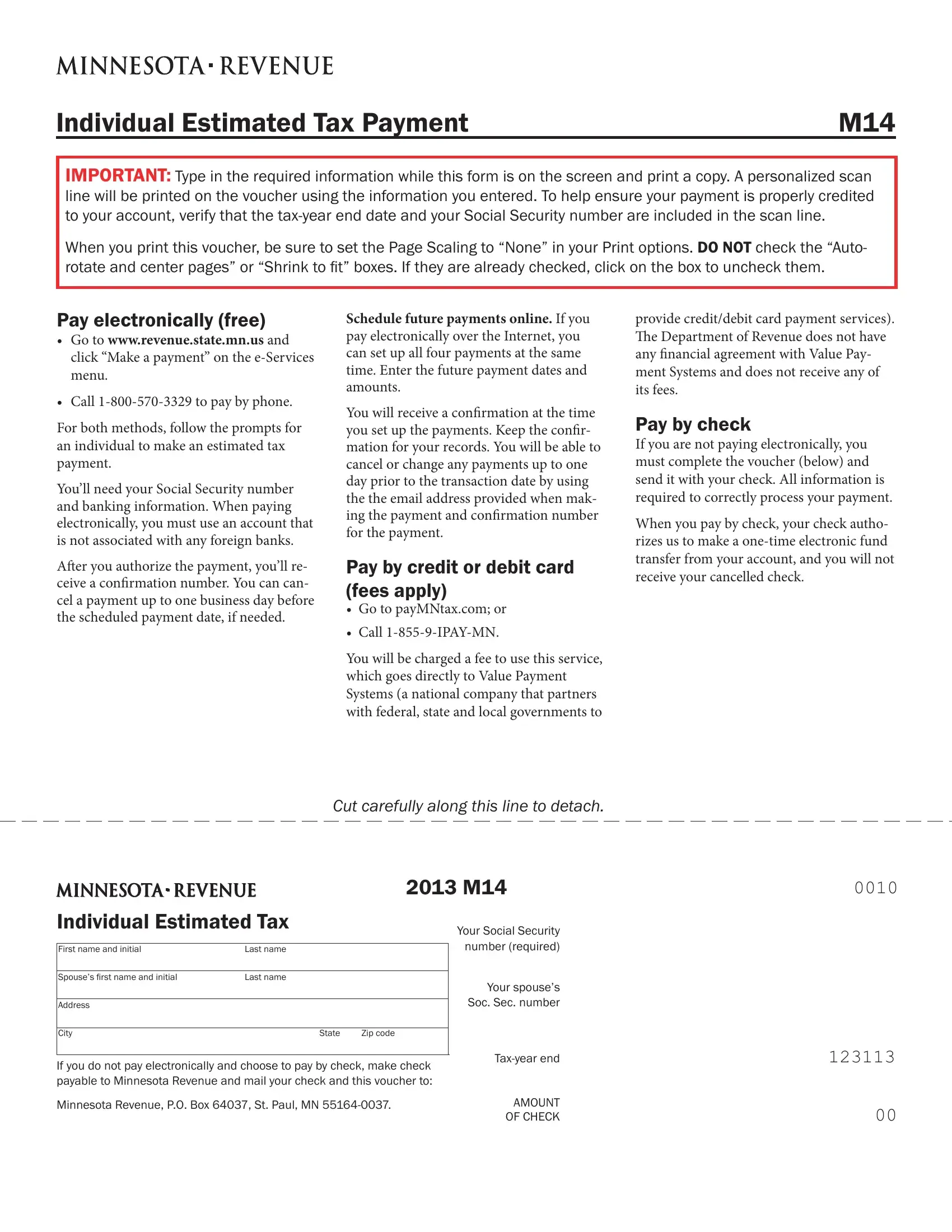

Individual Estimated Tax Payment PDF Form FormsPal

Go to ftb.ca.gov/pay for more information. Use web pay and enjoy the ease of our free online payment service. You can schedule your payments. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Estimated Tax Payments 2024 California Babb Mariam

Use web pay and enjoy the ease of our free online payment service. Go to ftb.ca.gov/pay for more information. You can schedule your payments. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to.

You Can Schedule Your Payments.

Estimated tax is used to. Go to ftb.ca.gov/pay for more information. Use web pay and enjoy the ease of our free online payment service. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.