Ca Form 568 Extension

Ca Form 568 Extension - The llc should file the appropriate california. Find out how to file form 568, limited liability. Learn about the tax and filing requirements for limited liability companies (llcs) in california. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. References in these instructions are to the internal revenue code. 2022 instructions for form 568, limited liability company return of income.

An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Learn about the tax and filing requirements for limited liability companies (llcs) in california. The llc should file the appropriate california. 2022 instructions for form 568, limited liability company return of income. Find out how to file form 568, limited liability. References in these instructions are to the internal revenue code.

An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. The llc should file the appropriate california. Find out how to file form 568, limited liability. 2022 instructions for form 568, limited liability company return of income. Learn about the tax and filing requirements for limited liability companies (llcs) in california. References in these instructions are to the internal revenue code.

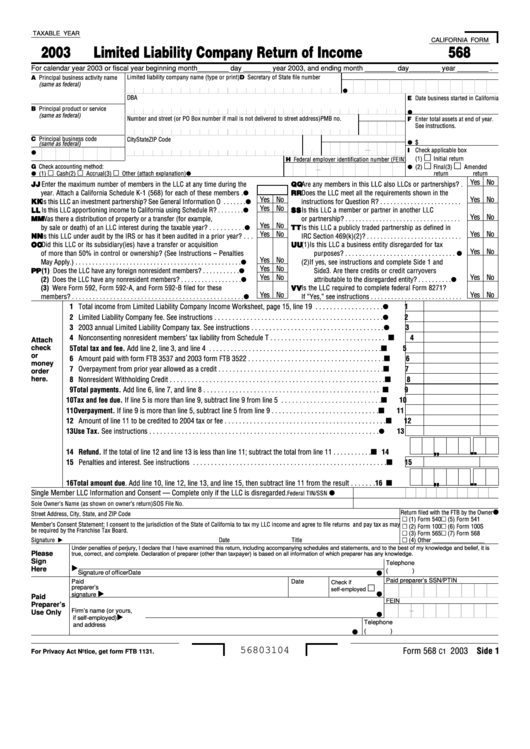

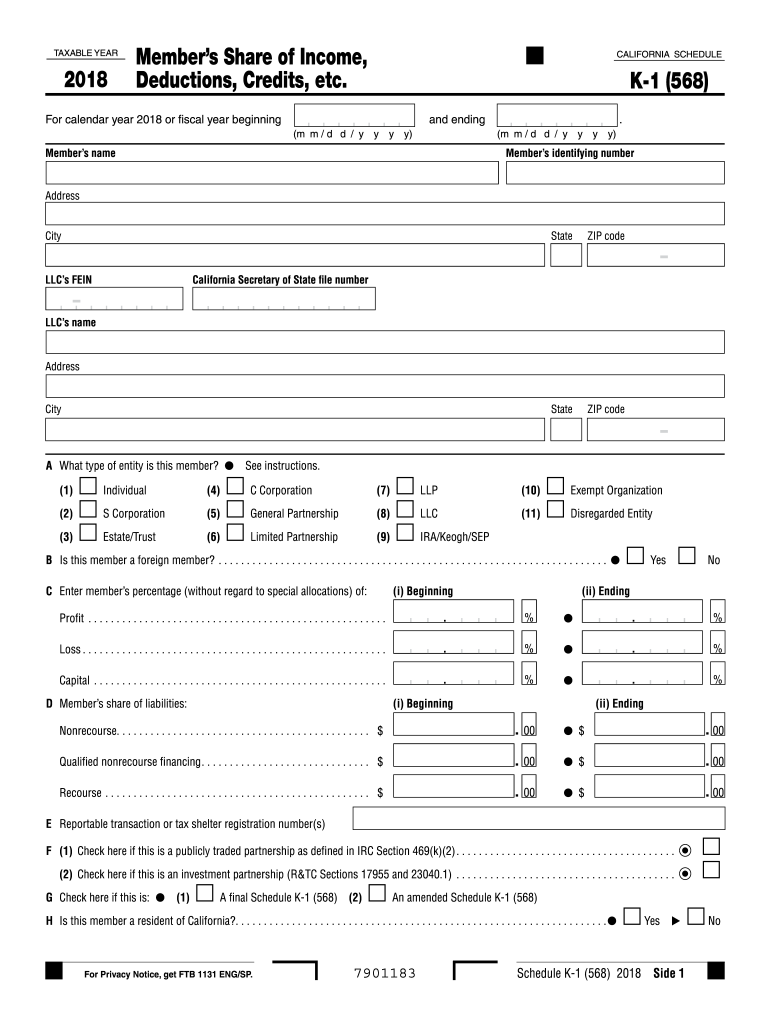

California Form 568 Limited Liability Company Return Of 2003

The llc should file the appropriate california. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. References in these instructions are to the internal revenue code. Find out how to file form 568, limited liability. Learn about the tax and filing requirements for limited liability companies (llcs) in california.

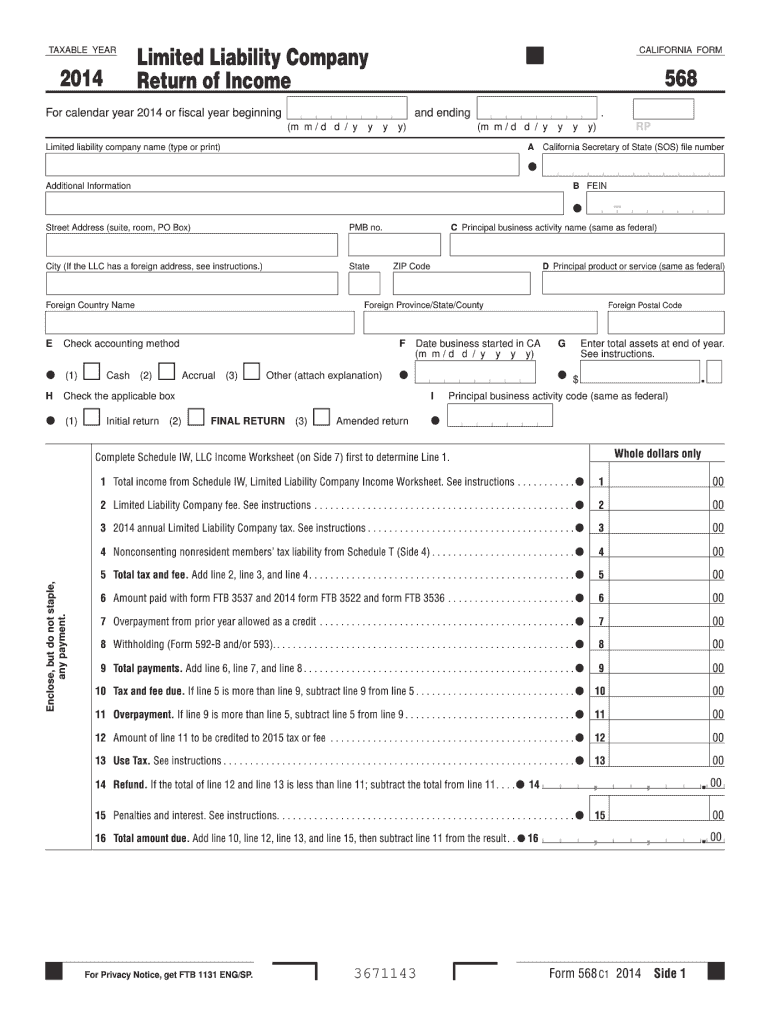

Form 568 Fill Out and Sign Printable PDF Template airSlate SignNow

Learn about the tax and filing requirements for limited liability companies (llcs) in california. The llc should file the appropriate california. References in these instructions are to the internal revenue code. Find out how to file form 568, limited liability. 2022 instructions for form 568, limited liability company return of income.

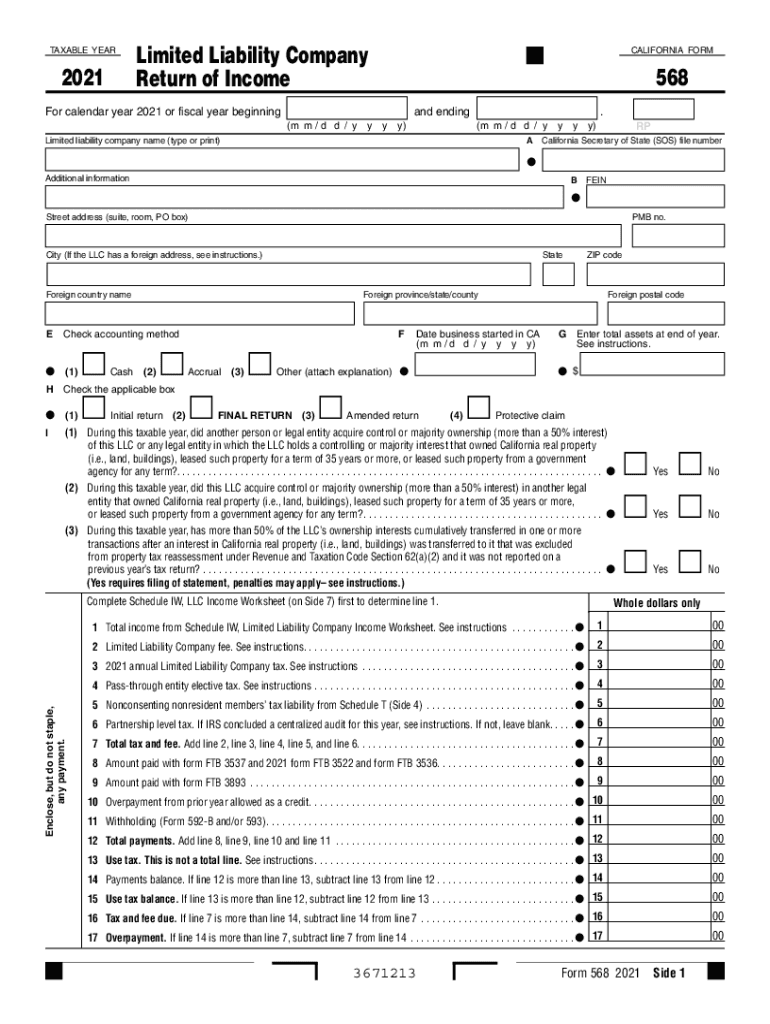

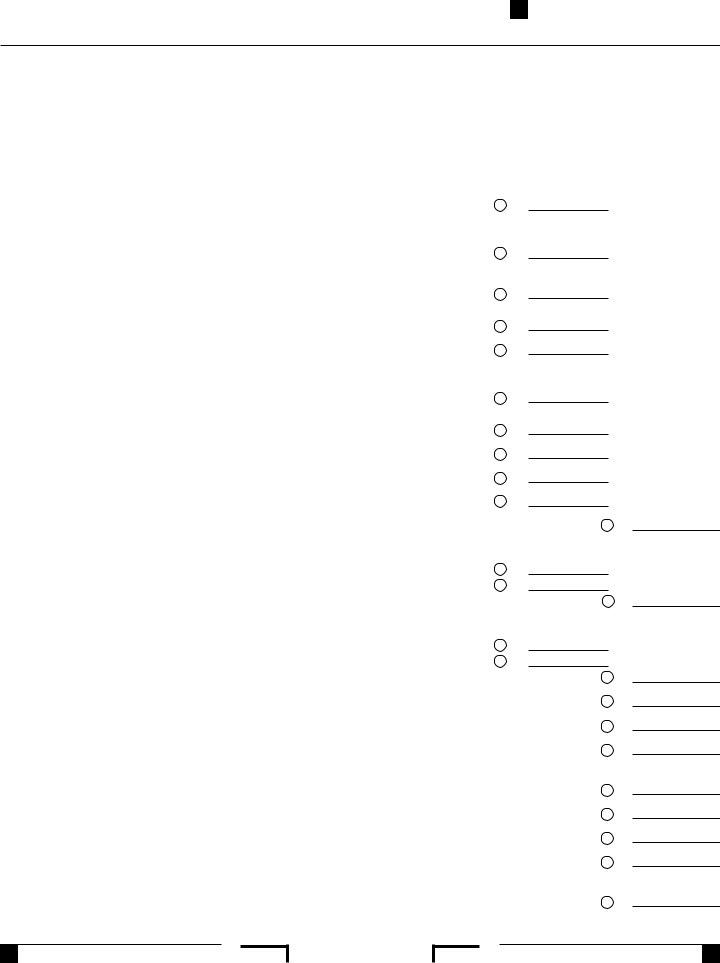

2023 Form 568 Printable Forms Free Online

Find out how to file form 568, limited liability. The llc should file the appropriate california. References in these instructions are to the internal revenue code. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Learn about the tax and filing requirements for limited liability companies (llcs) in california.

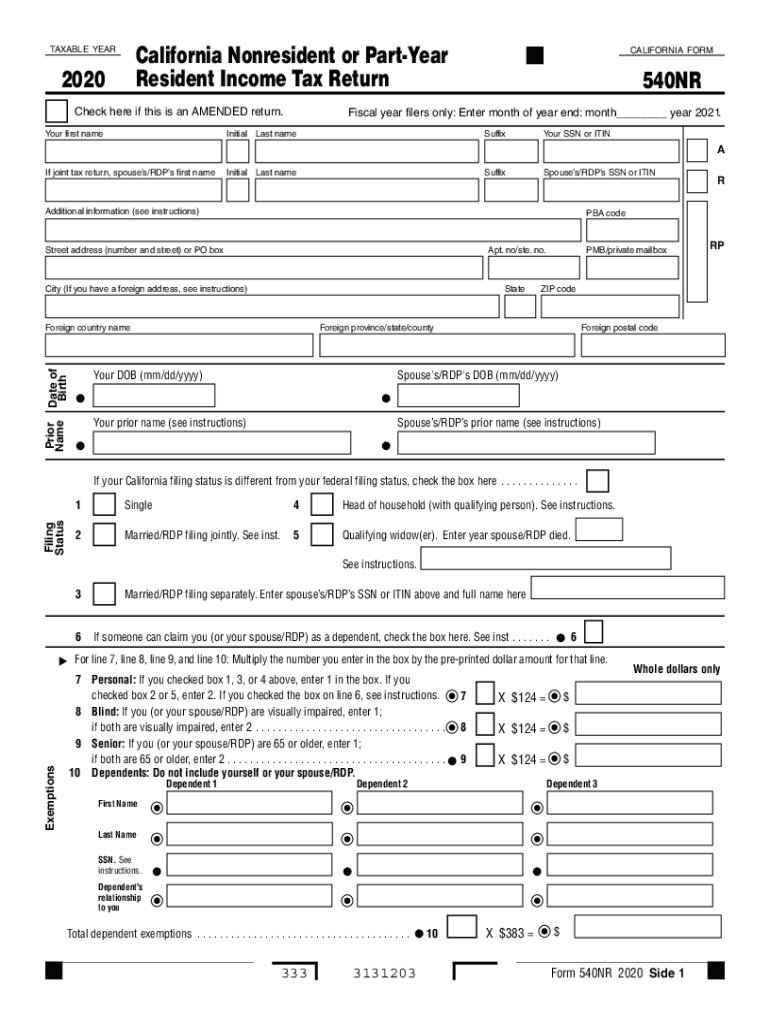

Year 20202024 Form Fill Out and Sign Printable PDF Template

2022 instructions for form 568, limited liability company return of income. The llc should file the appropriate california. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Learn about the tax and filing requirements for limited liability companies (llcs) in california. References in these instructions are to the internal revenue code.

Ca Form 568 ≡ Fill Out Printable PDF Forms Online

The llc should file the appropriate california. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Learn about the tax and filing requirements for limited liability companies (llcs) in california. References in these instructions are to the internal revenue code. Find out how to file form 568, limited liability.

2024 Instructions For Form Ftb 2024 India Lola Sibbie

The llc should file the appropriate california. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. References in these instructions are to the internal revenue code. Learn about the tax and filing requirements for limited liability companies (llcs) in california. Find out how to file form 568, limited liability.

Do I Need to File California Form 568 for LLCs with No

References in these instructions are to the internal revenue code. Find out how to file form 568, limited liability. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. The llc should file the appropriate california. Learn about the tax and filing requirements for limited liability companies (llcs) in california.

Ca 568 Instructions 20182024 Form Fill Out and Sign Printable PDF

An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Learn about the tax and filing requirements for limited liability companies (llcs) in california. The llc should file the appropriate california. References in these instructions are to the internal revenue code. Find out how to file form 568, limited liability.

CA FTB 568 2019 Fill out Tax Template Online US Legal Forms

References in these instructions are to the internal revenue code. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. The llc should file the appropriate california. 2022 instructions for form 568, limited liability company return of income. Learn about the tax and filing requirements for limited liability companies (llcs) in california.

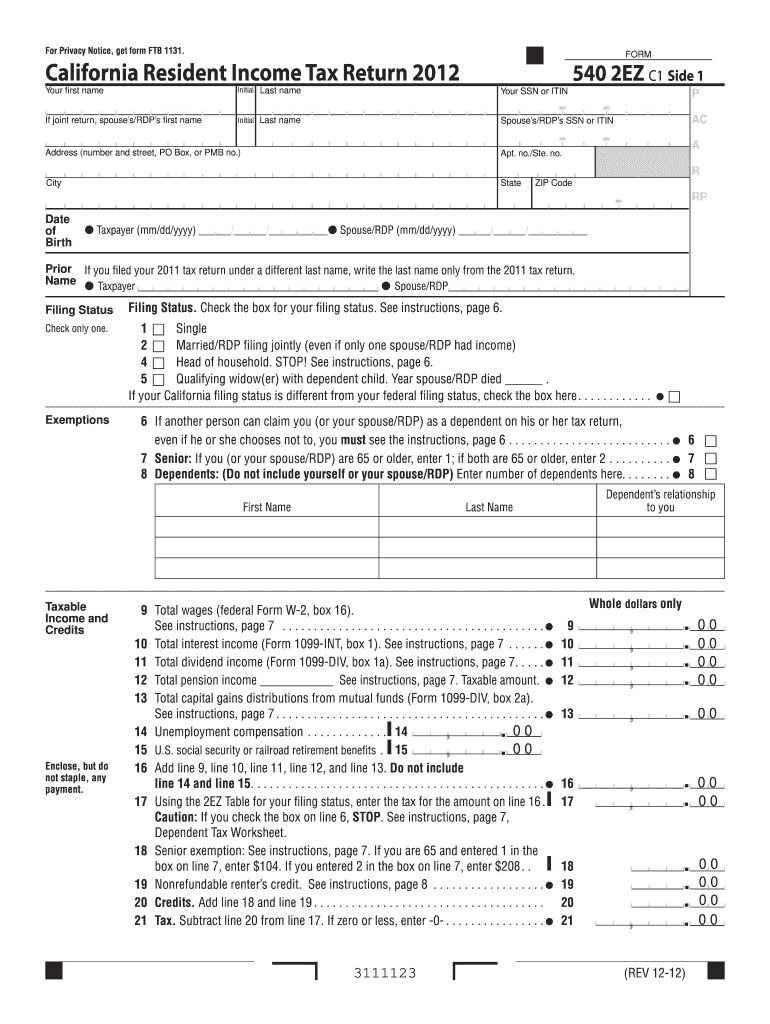

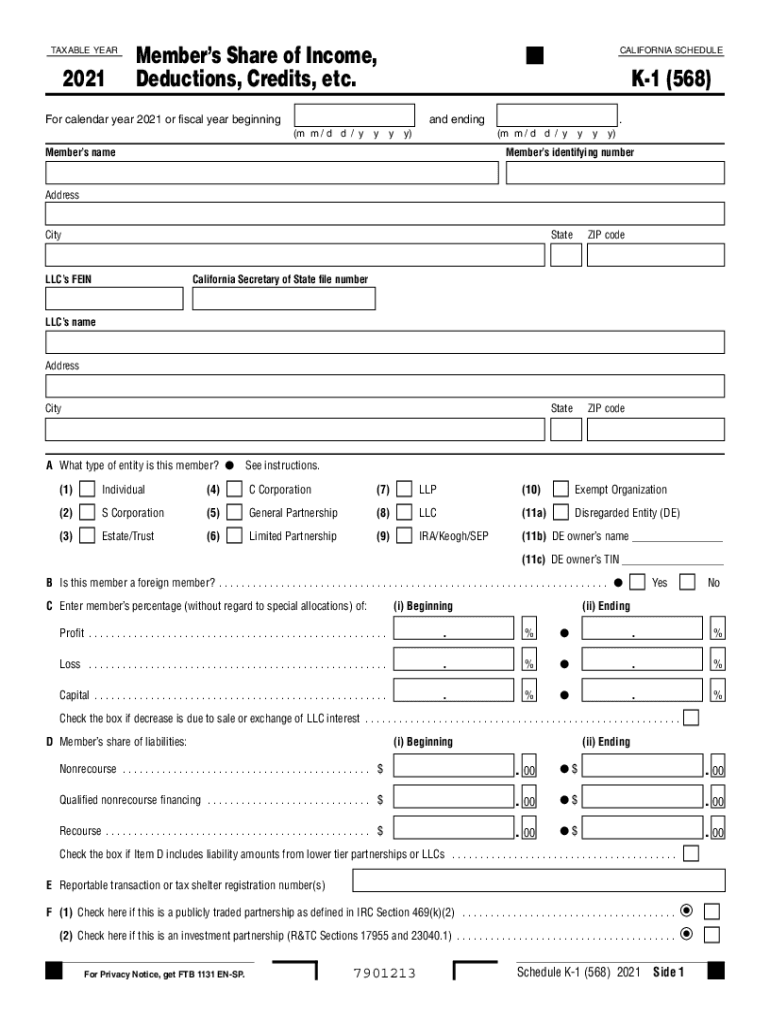

California Schedule K 1 568 Complete with ease airSlate SignNow

The llc should file the appropriate california. An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. 2022 instructions for form 568, limited liability company return of income. Learn about the tax and filing requirements for limited liability companies (llcs) in california. References in these instructions are to the internal revenue code.

Learn About The Tax And Filing Requirements For Limited Liability Companies (Llcs) In California.

An llc may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. 2022 instructions for form 568, limited liability company return of income. References in these instructions are to the internal revenue code. The llc should file the appropriate california.