Arizona Form 165 Instructions 2022

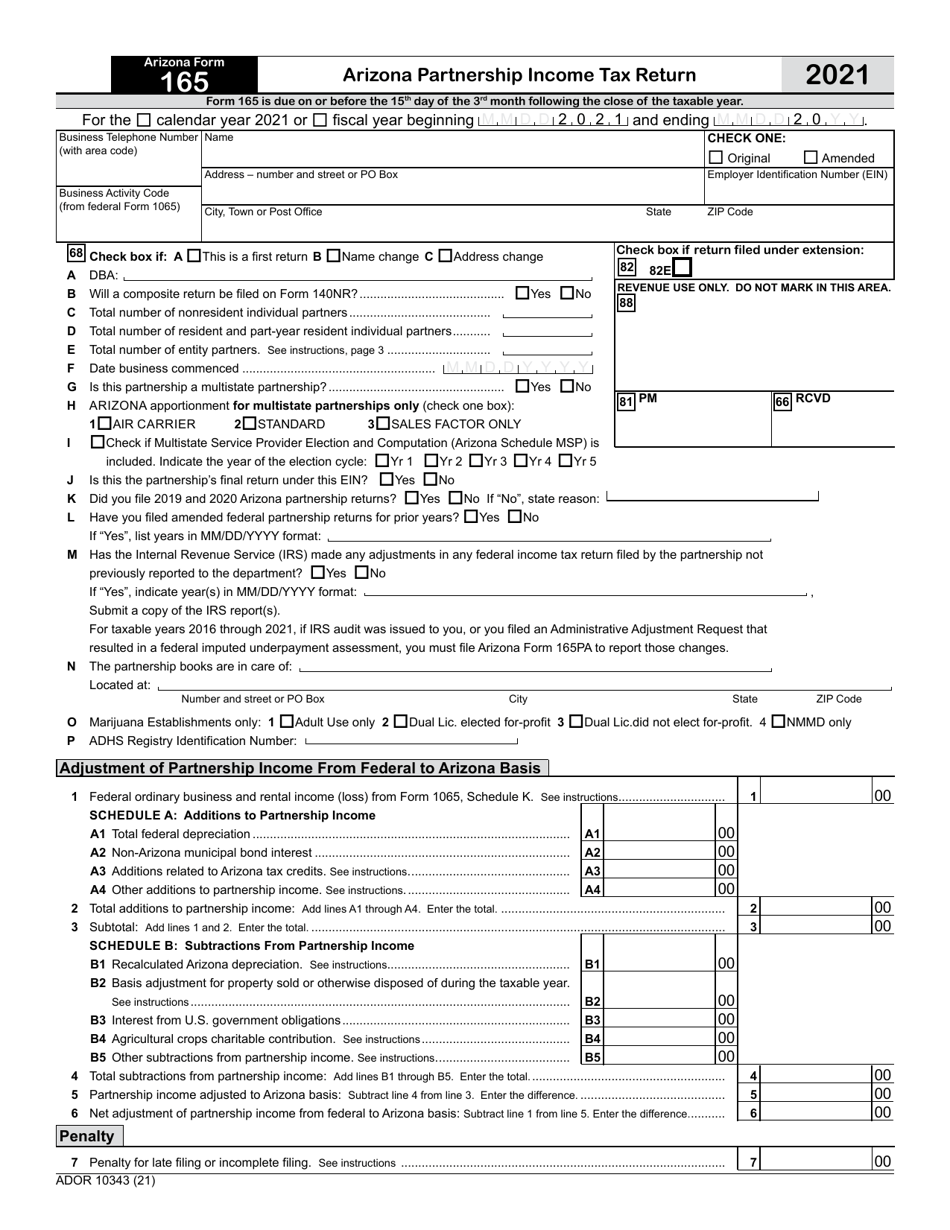

Arizona Form 165 Instructions 2022 - For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income. For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative.

The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income. For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative.

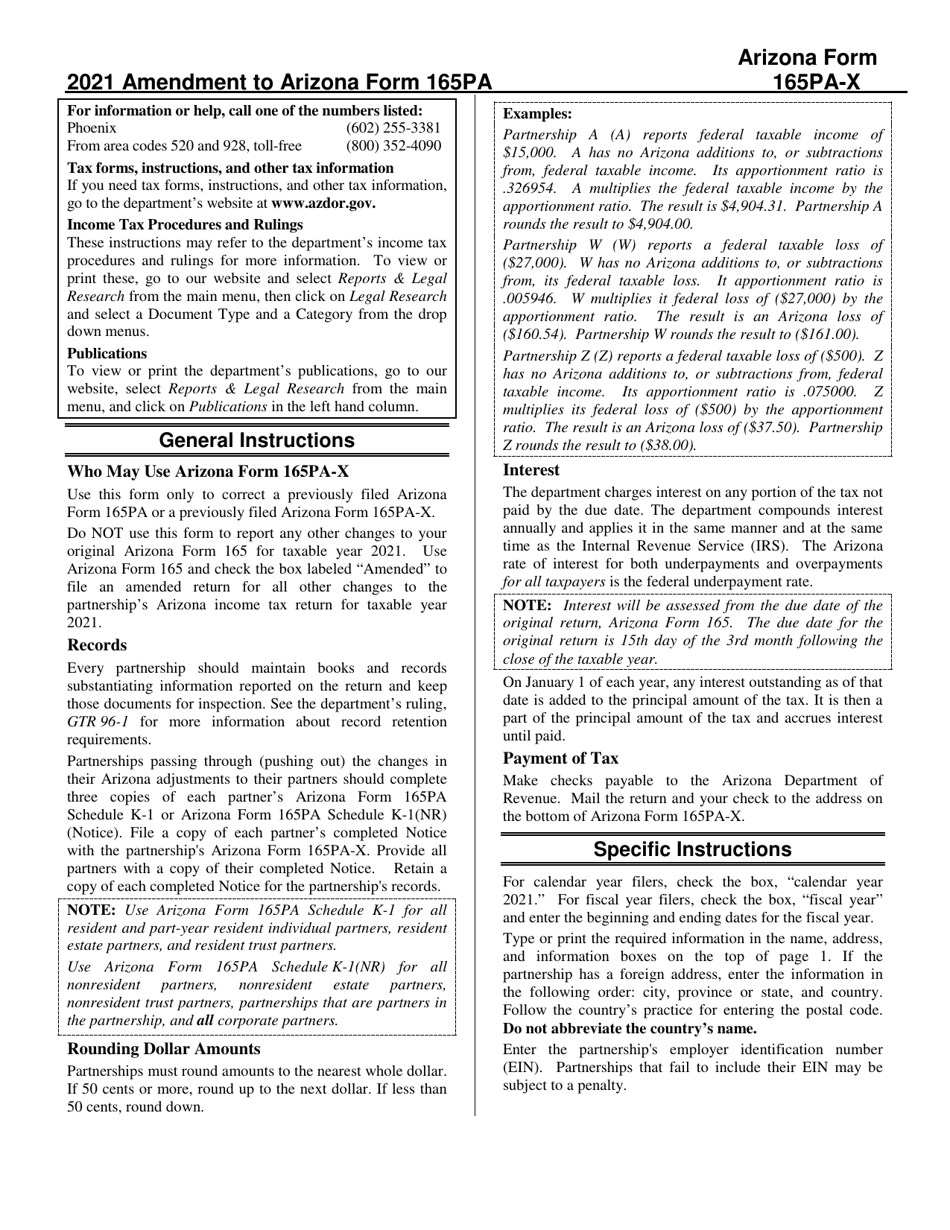

Download Instructions for Arizona Form 165PAX, ADOR11318 Amendment to

The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income. For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative.

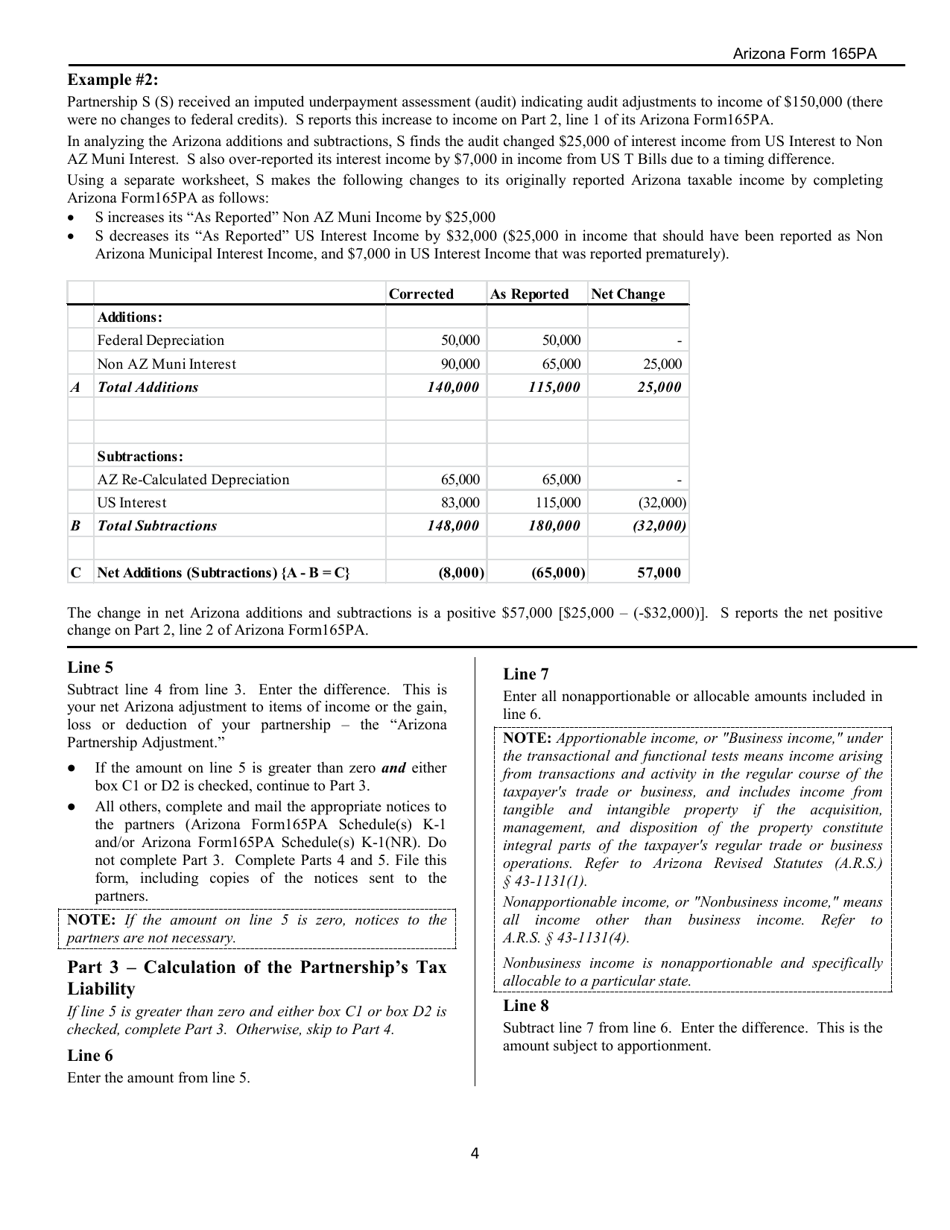

Download Instructions for Arizona Form 165PA, ADOR11291 Arizona

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

Fillable Online Form RCL201B Arizona Registrar of Contractors az

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

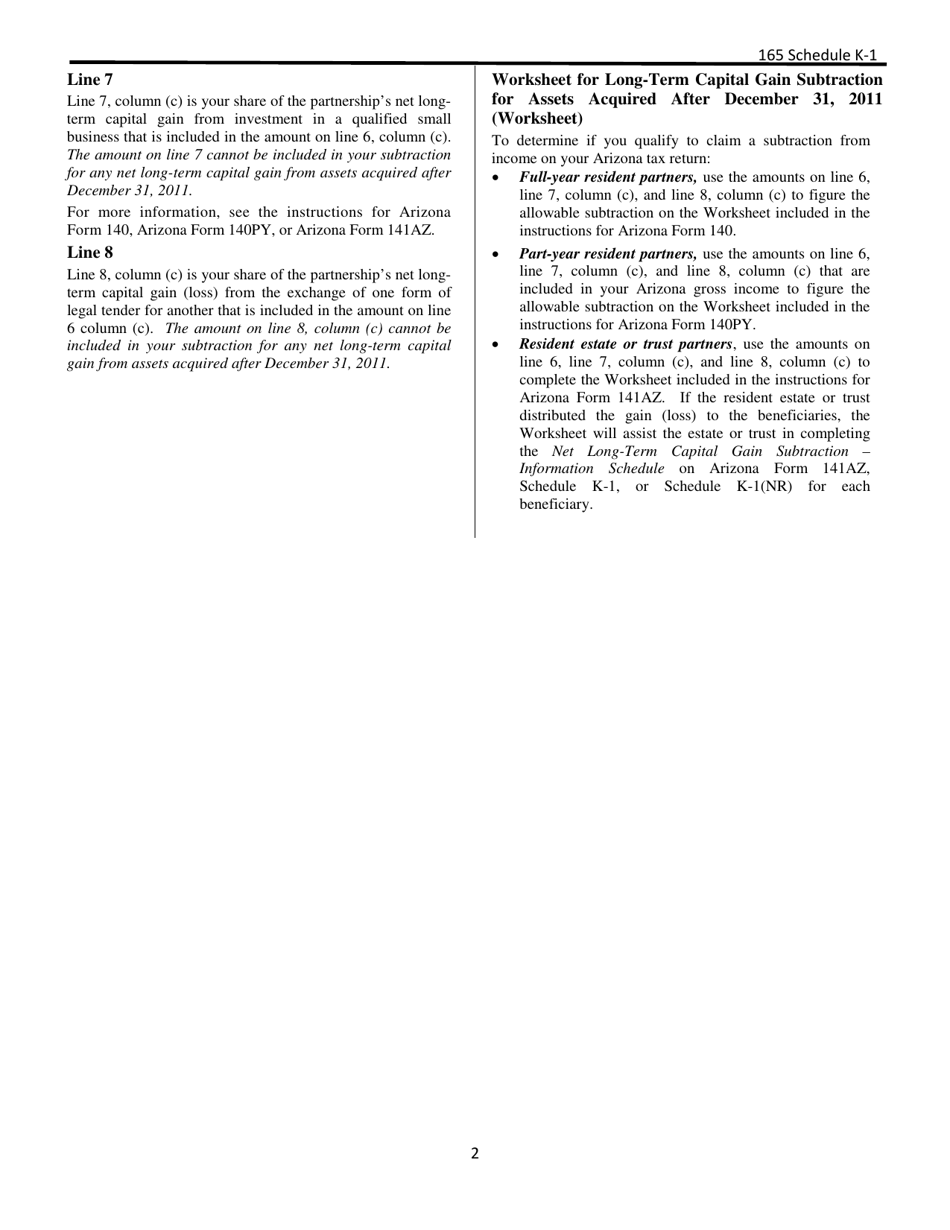

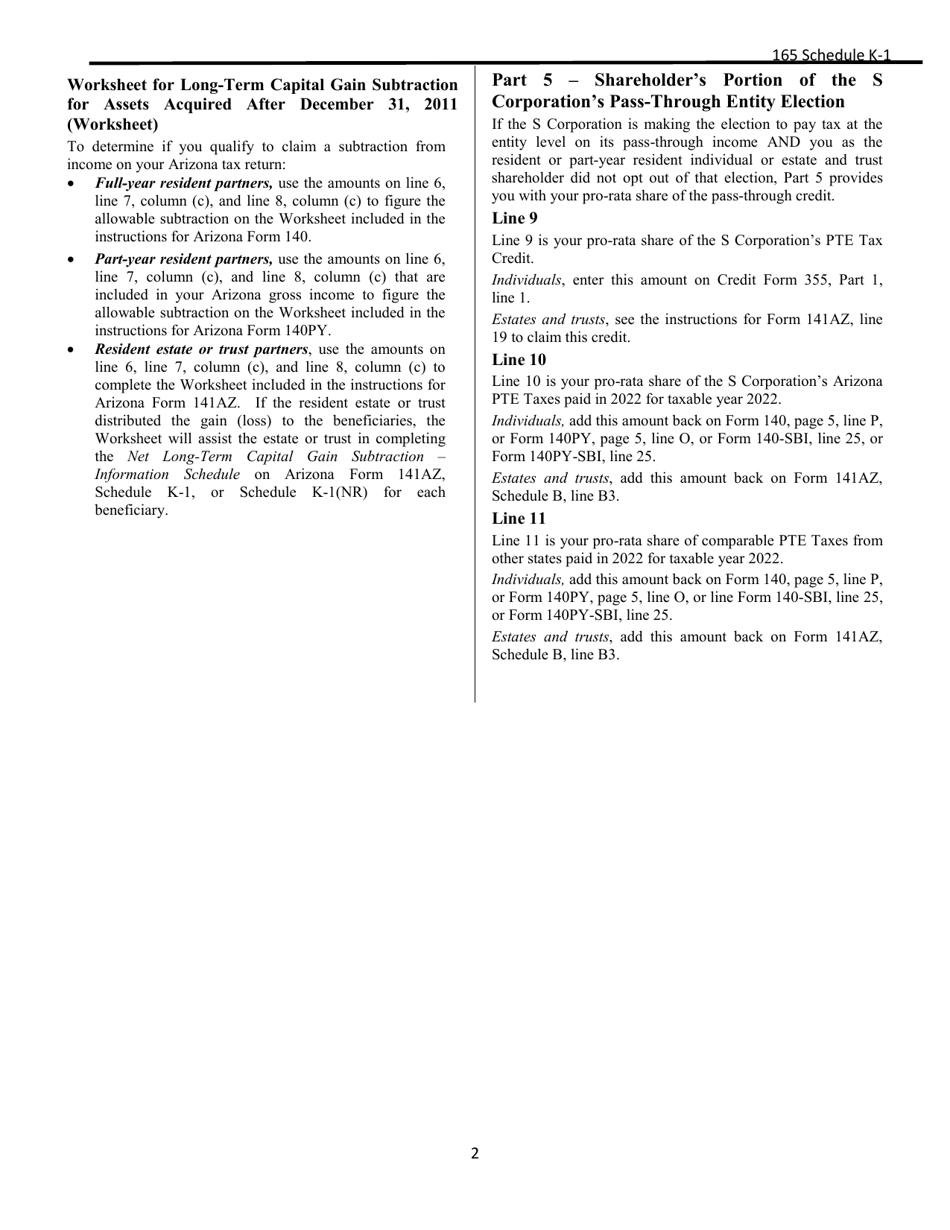

Download Instructions for Arizona Form 165 Schedule K1 Resident and

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

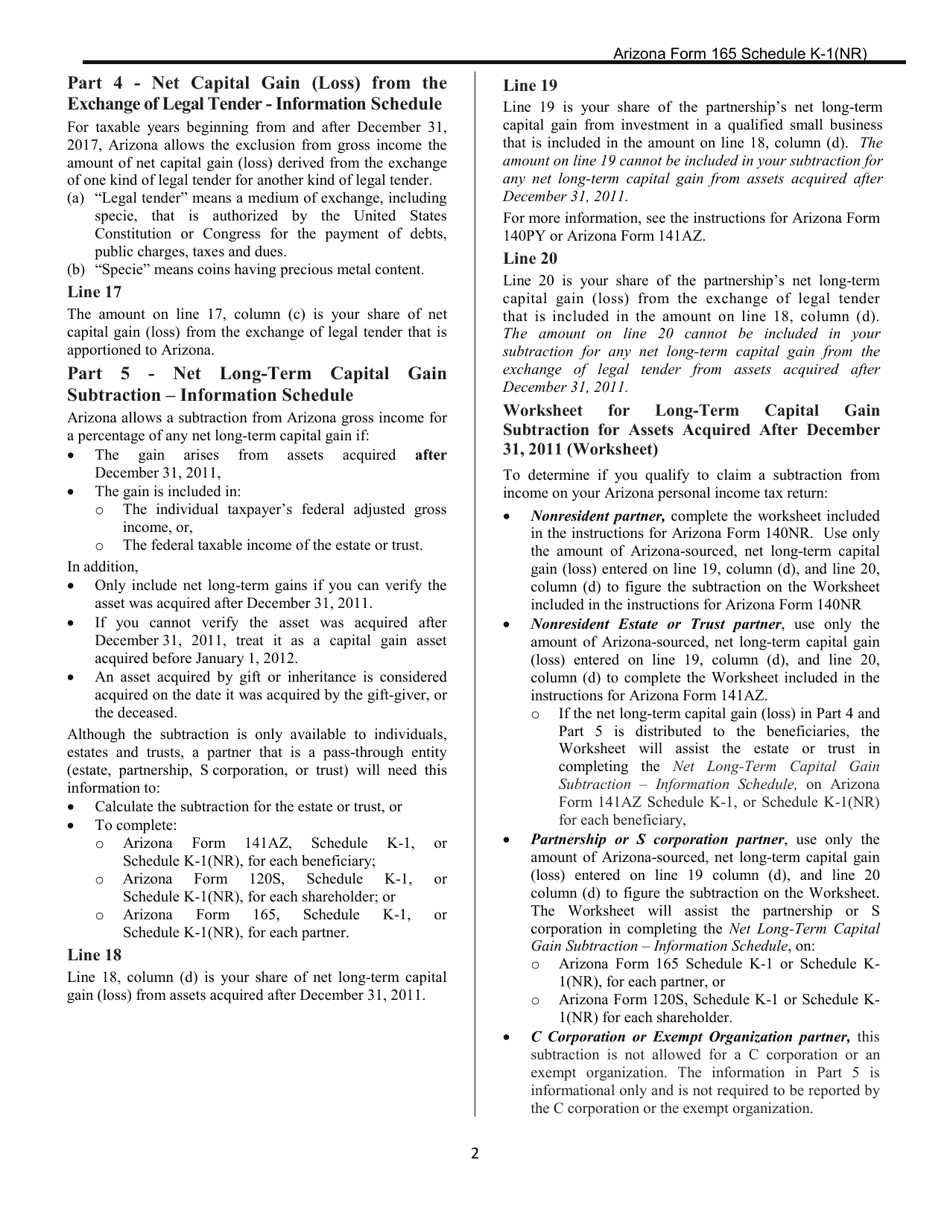

Download Instructions for Arizona Form 165, ADOR10345 Schedule K1(NR

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

Arizona Form 165 (ADOR10343) 2021 Fill Out, Sign Online and

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

California Notice of Proposed Action Form DE165 Instructions Probate

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

Arizona Form 165 Instructions Form example download

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

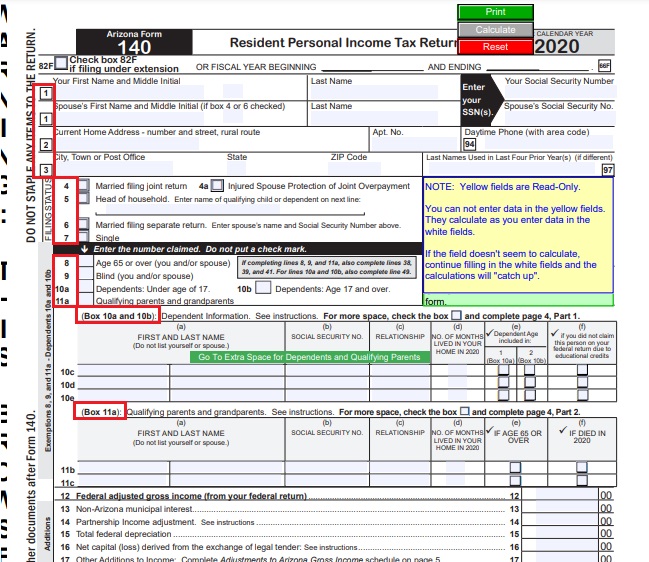

Instructions and Download of Arizona Form 140 Unemployment Gov

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative. The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income.

Download Instructions for Arizona Form 165, ADOR10344 Schedule K1

The 2022 arizona partnership income tax return form 165 is essential for domestic partnerships to report their income. For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative.

The 2022 Arizona Partnership Income Tax Return Form 165 Is Essential For Domestic Partnerships To Report Their Income.

For taxable years 2016 through 2022, if you received a federal imputed underpayment assessment, or you filed an administrative.