Address To Send Form 9465

Address To Send Form 9465 - How to file form 9465 & address to send to. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. Your only option is to send your. If you have already filed your. Please see this irs link scroll down towards the bottom of the page and depending on what state you live in it will show you the. Send the completed form along with any supporting documents to the designated irs mailing address listed on the instructions. Unfortunately, the irs no longer has a published fax number for form 9465 submissions. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f,. If you need to send.

Unfortunately, the irs no longer has a published fax number for form 9465 submissions. If you have already filed your. Send the completed form along with any supporting documents to the designated irs mailing address listed on the instructions. Please see this irs link scroll down towards the bottom of the page and depending on what state you live in it will show you the. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f,. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. How to file form 9465 & address to send to. Your only option is to send your. If you need to send. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet.

Send the completed form along with any supporting documents to the designated irs mailing address listed on the instructions. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you need to send. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f,. How to file form 9465 & address to send to. Please see this irs link scroll down towards the bottom of the page and depending on what state you live in it will show you the. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. Unfortunately, the irs no longer has a published fax number for form 9465 submissions. If you have already filed your. Your only option is to send your.

oxio

Send the completed form along with any supporting documents to the designated irs mailing address listed on the instructions. Your only option is to send your. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f,. Unfortunately, the irs no longer has a published fax.

How to fill out Form9465 online Lumin

Send the completed form along with any supporting documents to the designated irs mailing address listed on the instructions. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f,. If you have already filed your. Your only option is to send your. Unfortunately, the irs.

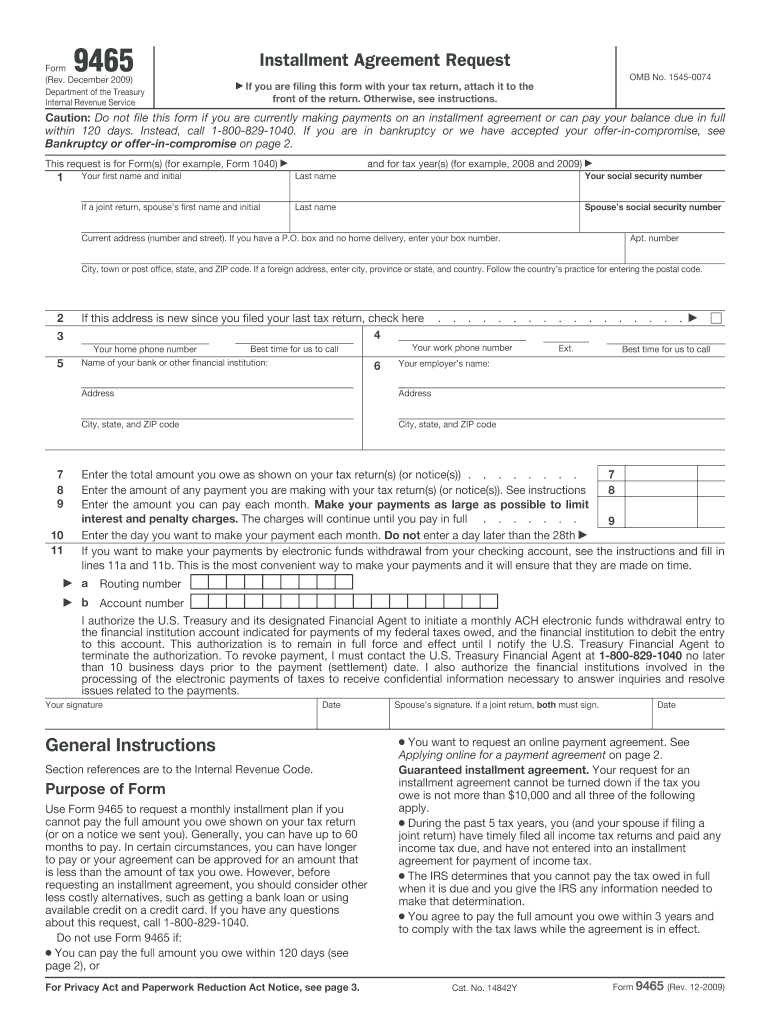

2009 Form IRS 9465 Fill Online, Printable, Fillable, Blank pdfFiller

Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. Send the completed form along with any supporting documents to the designated irs mailing address listed on.

Irs Form 9465 Form Fillable Printable Forms Free Online

To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. Please see this irs link scroll down towards the bottom of the page and depending on what state you live in it will show you the. Unfortunately, the irs no longer has a published fax number for form.

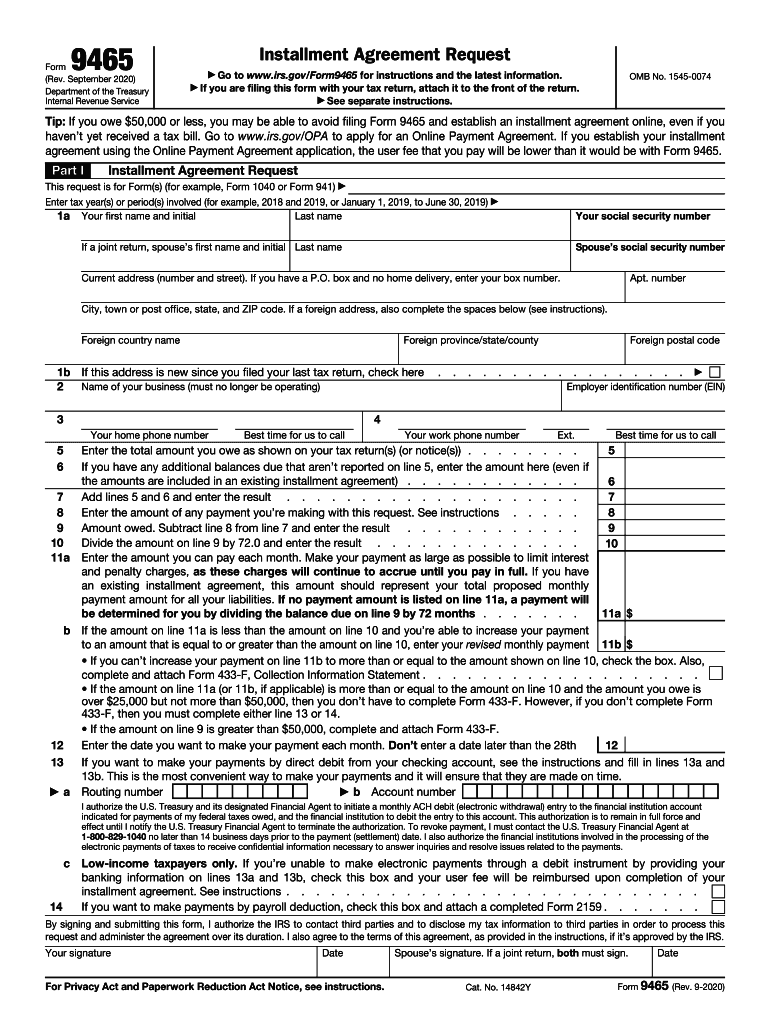

Complete Guide To IRS Form 9465 Installment Agreement Request

Your only option is to send your. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. Send the completed form along with any supporting documents to the designated irs mailing address listed on the instructions. Please see this irs link scroll down towards the bottom of the.

IRS Form 9465 Instructions Your Installment Agreement Request

Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you have already filed your. Send the completed form along with any supporting documents to the designated irs mailing address listed on the instructions. All individual taxpayers who mail form 9465 separate from their returns and who do.

Address send form 9465 Fill online, Printable, Fillable Blank

To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. If you need to send. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f,. Attach form 9465 to the front of your.

mailbox vector icon. post, envelope, communication, letter, email

Your only option is to send your. How to file form 9465 & address to send to. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Unfortunately, the irs no longer has a published fax number for form 9465 submissions. To file form 9465 on paper, click on.

IRS Form 9465 Complete Guide To Installment Agreement

How to file form 9465 & address to send to. Attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. Send the completed form along with any.

Contact Us Glyph Icon Pack 5 Icon Design. question. computer. address

Unfortunately, the irs no longer has a published fax number for form 9465 submissions. If you need to send. If you have already filed your. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f,. Send the completed form along with any supporting documents to.

Your Only Option Is To Send Your.

How to file form 9465 & address to send to. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the. Please see this irs link scroll down towards the bottom of the page and depending on what state you live in it will show you the. Send the completed form along with any supporting documents to the designated irs mailing address listed on the instructions.

Attach Form 9465 To The Front Of Your Return And Send It To The Address Shown In Your Tax Return Booklet.

Unfortunately, the irs no longer has a published fax number for form 9465 submissions. If you need to send. All individual taxpayers who mail form 9465 separate from their returns and who do not file a form 1040 with schedule(s) c, e, or f,. If you have already filed your.