Additional Medicare Tax

Additional Medicare Tax - The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. This article explains the medicare standard tax and the medicare additional tax. Find information on the additional medicare tax. You’ll only have to pay the additional tax if your income surpasses a specific. It applies to taxpayers who earn over a set income threshold. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does.

It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. You’ll only have to pay the additional tax if your income surpasses a specific. Find information on the additional medicare tax. It applies to taxpayers who earn over a set income threshold. This article explains the medicare standard tax and the medicare additional tax. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare.

The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. It applies to taxpayers who earn over a set income threshold. Find information on the additional medicare tax. This article explains the medicare standard tax and the medicare additional tax. You’ll only have to pay the additional tax if your income surpasses a specific. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare.

Understanding the Additional Medicare Tax For High Earners

You’ll only have to pay the additional tax if your income surpasses a specific. Find information on the additional medicare tax. It applies to taxpayers who earn over a set income threshold. This article explains the medicare standard tax and the medicare additional tax. It also looks at who pays the additional tax, how the irs calculates it, and how.

Additional Medicare Tax Limit 2024 Leta Brittani

Find information on the additional medicare tax. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. It applies to taxpayers who earn over a set income threshold. This article explains the medicare standard tax and the medicare additional tax. You’ll only have to pay the additional tax if your income surpasses.

What Is Additional Medicare Tax? A Comprehensive Guide The

It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. Find information on the additional medicare tax. It applies to taxpayers who earn over a set income threshold. This article explains the.

What Is Additional Medicare Tax? A Comprehensive Guide The

You’ll only have to pay the additional tax if your income surpasses a specific. This article explains the medicare standard tax and the medicare additional tax. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. It applies to taxpayers who earn over a set income threshold. Find information on.

Understanding Medicare Additional Tax

The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. You’ll only have to pay the additional tax if your income surpasses a specific. It applies to taxpayers who earn over a set income threshold..

Additional Medicare Tax Information for Employers

The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. This article explains the medicare.

Additional Medicare Tax 2024 Form 2024 Application Tobe Adriena

It applies to taxpayers who earn over a set income threshold. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. You’ll only have to pay the additional tax if your income surpasses a specific. Find information on the additional medicare tax. This article explains the medicare standard tax and the medicare additional.

What Is Medicare Tax? Definitions, Rates and Calculations ValuePenguin

You’ll only have to pay the additional tax if your income surpasses a specific. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare. Find information on the additional medicare tax. It applies to taxpayers who earn over a set income threshold. It also looks at who pays the additional tax, how.

What is Medicare Tax Purpose, Rate, Additional Medicare, and More

It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. This article explains the medicare standard tax and the medicare additional tax. It applies to taxpayers who earn over a set income threshold..

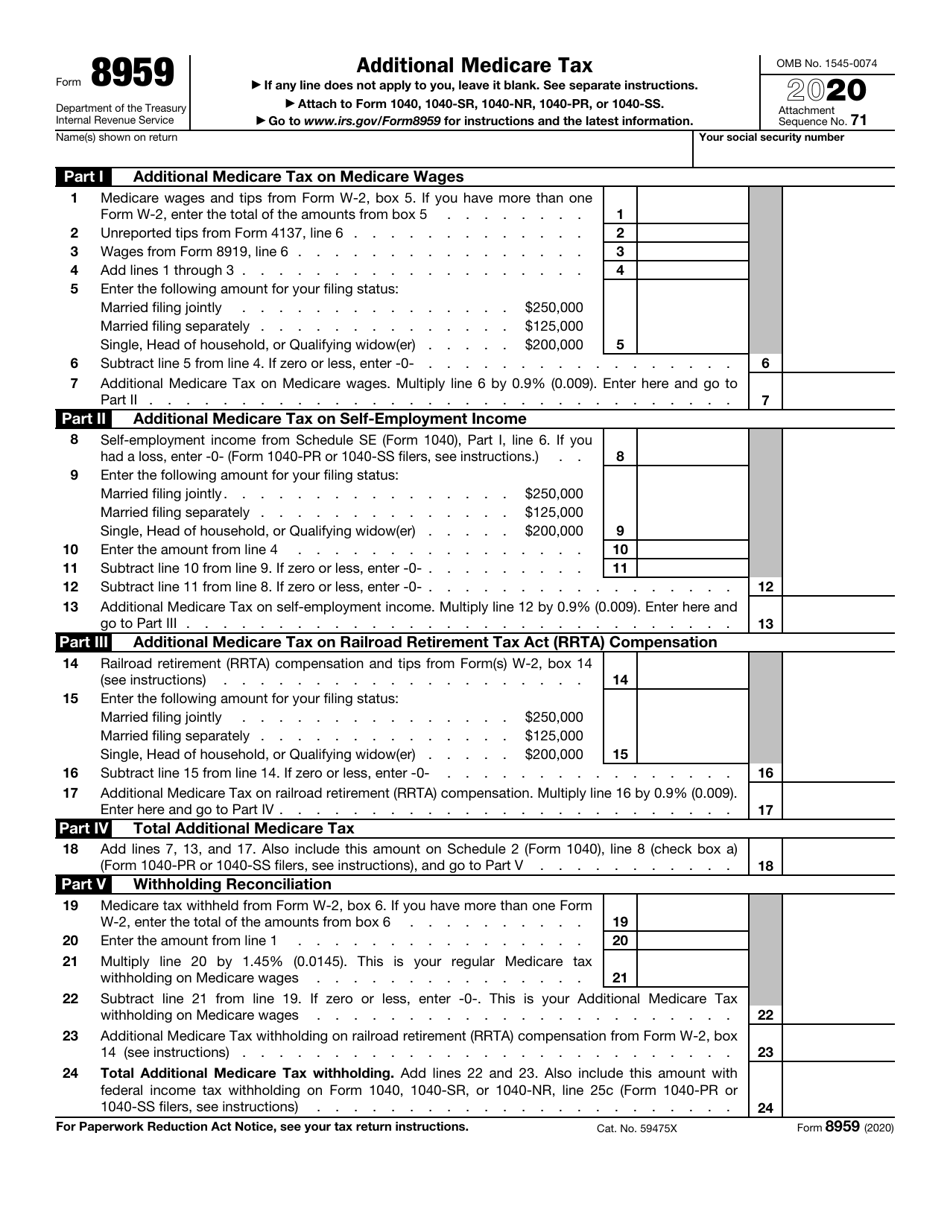

Form 8959 Additional Medicare Tax (2014) Free Download

You’ll only have to pay the additional tax if your income surpasses a specific. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does. It applies to taxpayers who earn over a set income threshold. The additional medicare tax is an extra 0.9% tax on top of the standard tax payment for medicare..

The Additional Medicare Tax Is An Extra 0.9% Tax On Top Of The Standard Tax Payment For Medicare.

You’ll only have to pay the additional tax if your income surpasses a specific. It also looks at who pays the additional tax, how the irs calculates it, and how the government uses the. This article explains the medicare standard tax and the medicare additional tax. The additional medicare tax is 0.9%, but it doesn’t apply to everyone like standard medicare tax does.

It Applies To Taxpayers Who Earn Over A Set Income Threshold.

Find information on the additional medicare tax.

:max_bytes(150000):strip_icc()/GettyImages-151333466-5661ad343df78cedb0b6a924.jpg)