2553 Tax Form

2553 Tax Form - As of the 2018 tax year, form 1040, u.s. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Individual income tax return, is the only form used for personal. What is irs form 2553? Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have.

Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. What is irs form 2553? Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. As of the 2018 tax year, form 1040, u.s. Individual income tax return, is the only form used for personal.

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. As of the 2018 tax year, form 1040, u.s. What is irs form 2553? Individual income tax return, is the only form used for personal. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have.

IRS Form 2553 Instructions How and Where to File This Tax Form

As of the 2018 tax year, form 1040, u.s. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. What is irs form 2553? Individual income tax return, is.

Learn How to Fill the Form 2553 Election by a Small Business

Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. As of the 2018 tax year, form 1040, u.s. Individual income tax return, is the only form used for.

How to Fill out IRS Form 2553 EasytoFollow Instructions YouTube

Individual income tax return, is the only form used for personal. As of the 2018 tax year, form 1040, u.s. What is irs form 2553? Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Form 2553 is the irs form for small business corporations and limited liability companies to elect.

Government Templates ONLYOFFICE

As of the 2018 tax year, form 1040, u.s. What is irs form 2553? Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is.

How to Fill in Form 2553 Election by a Small Business Corporation S

What is irs form 2553? Individual income tax return, is the only form used for personal. As of the 2018 tax year, form 1040, u.s. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Form 2553 is the irs form for small business corporations and limited liability companies to elect.

2002 Form IRS 2553 Fill Online, Printable, Fillable, Blank pdfFiller

Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. As of the 2018 tax year, form 1040, u.s. What is irs form 2553? Form 2553 is the irs form for small business corporations and limited liability companies to elect.

Form 2553 Election by a Small Business Corporation (2014) Free Download

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. What is irs form 2553? Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. As of the.

Barbara Johnson Blog Form 2553 Instructions How and Where to File

What is irs form 2553? As of the 2018 tax year, form 1040, u.s. Individual income tax return, is the only form used for personal. Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Form 2553 is the irs form for small business corporations and limited liability companies to elect.

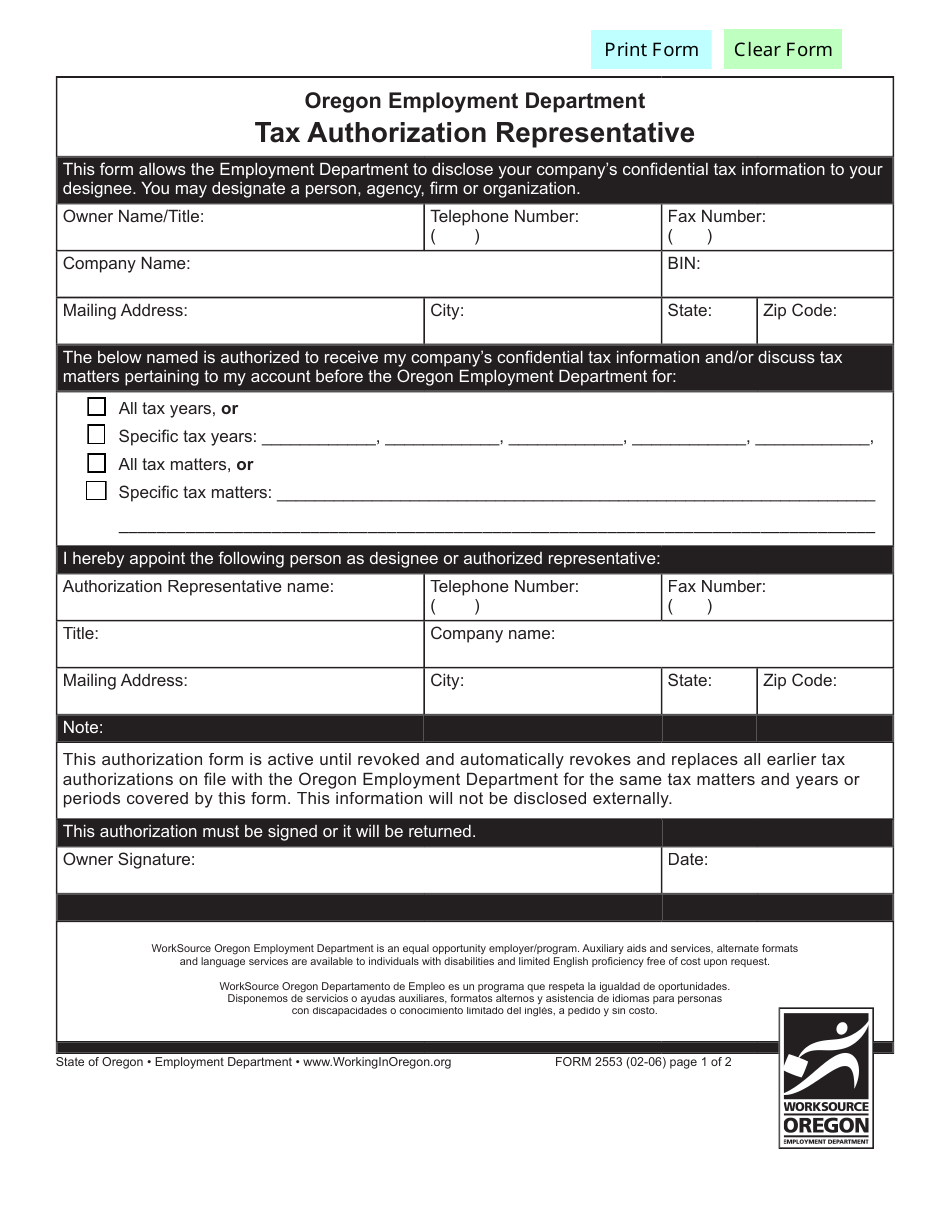

Form 2553 Fill Out, Sign Online and Download Fillable PDF, Oregon

As of the 2018 tax year, form 1040, u.s. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. What is irs form 2553? Individual income tax return, is the only form used for personal. Business owners who have structured their business as a c corporation (c corp).

Irs 2553 Form S Corporation Irs Tax Forms

Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. Individual income tax return, is the only form used for personal. What is irs form 2553? Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. As of the.

As Of The 2018 Tax Year, Form 1040, U.s.

Business owners who have structured their business as a c corporation (c corp) or limited liability company (llc) have. Individual income tax return, is the only form used for personal. Form 2553 is the irs form for small business corporations and limited liability companies to elect to be treated as s corporations. What is irs form 2553?