2022 California Estimated Tax Worksheet

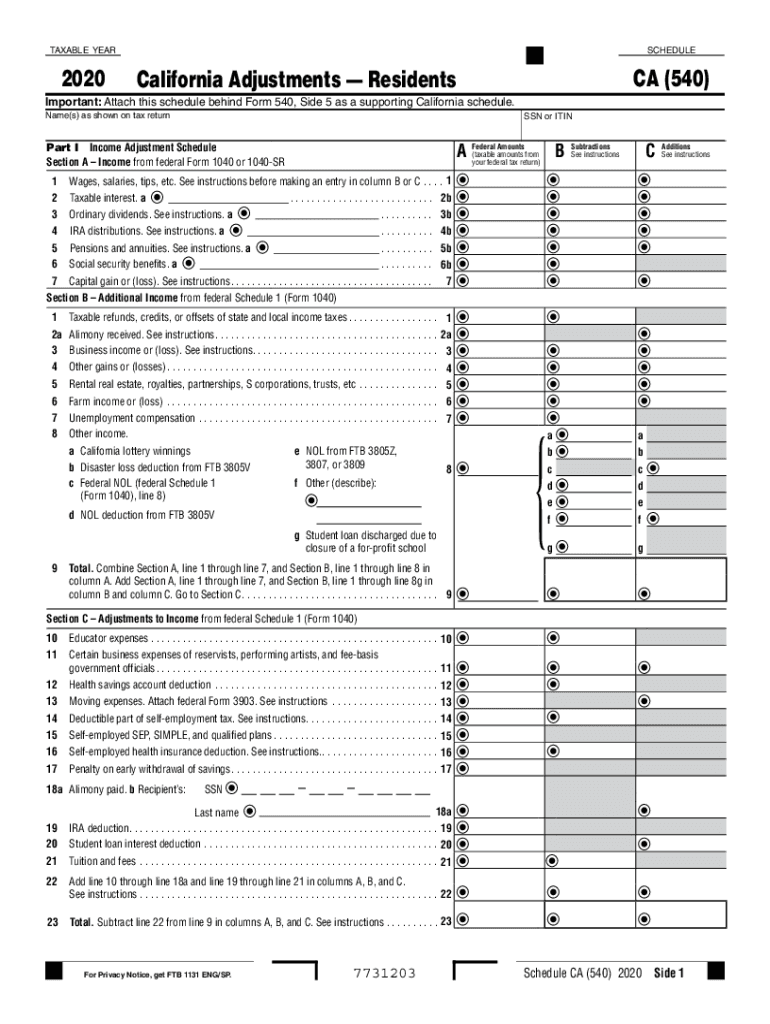

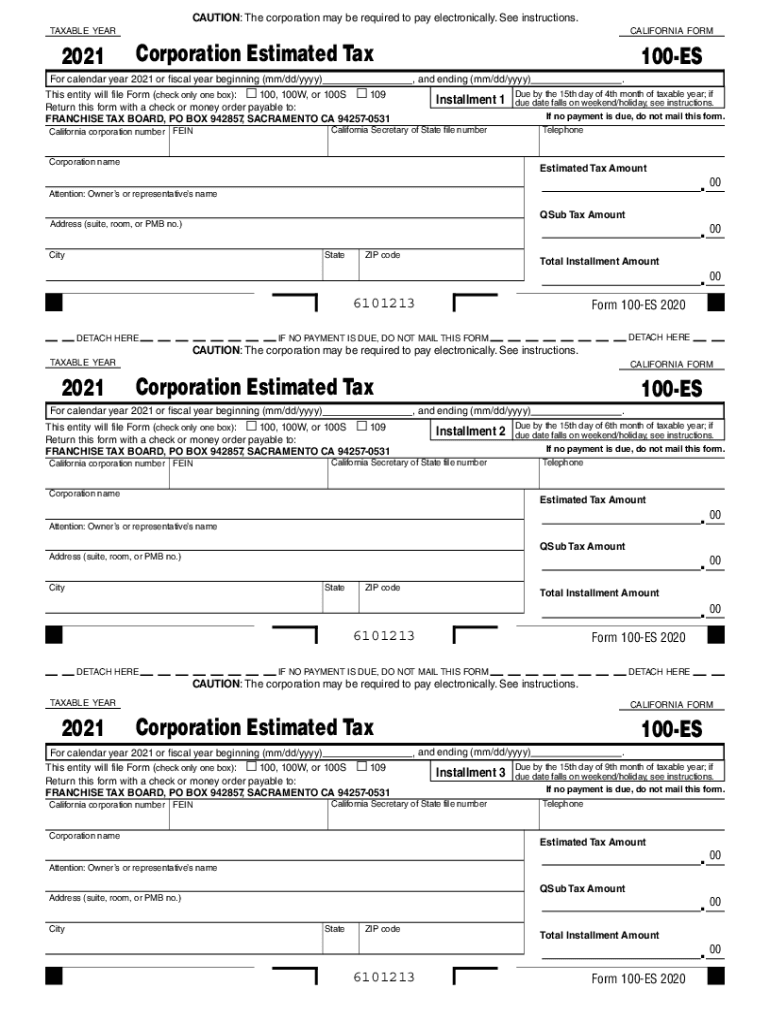

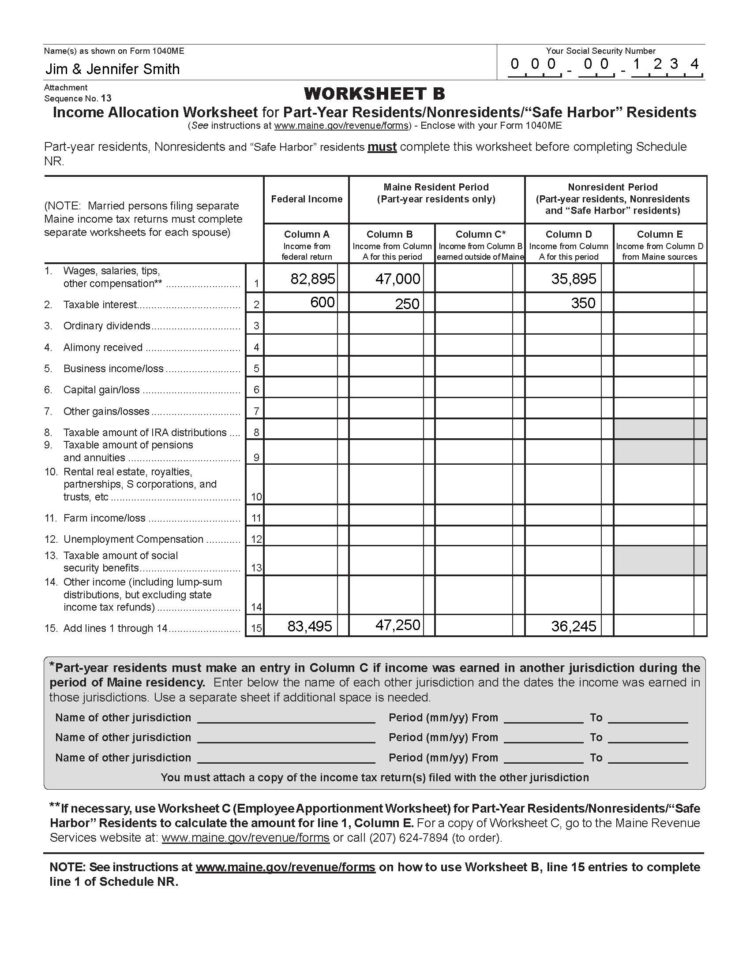

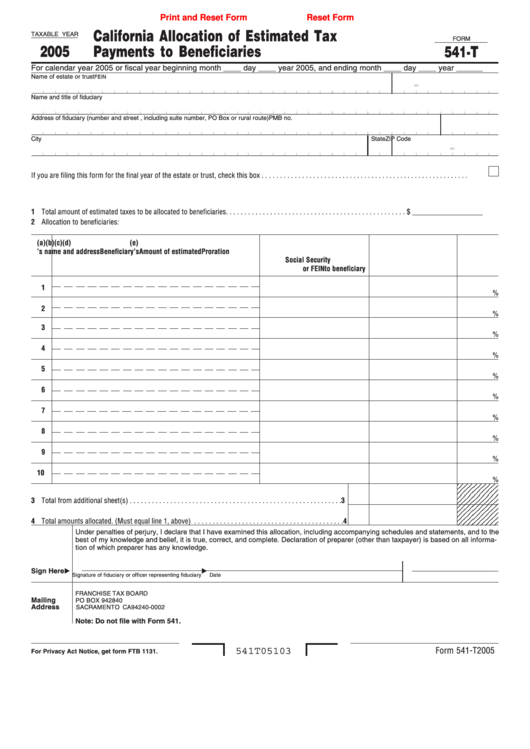

2022 California Estimated Tax Worksheet - The federal or irs taxes are listed. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. Mail this form and your check or. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. The california tax estimator lets you calculate your state taxes for the tax year. Use 100% of the 2025 estimated total tax.

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. The federal or irs taxes are listed. The california tax estimator lets you calculate your state taxes for the tax year. Estimated tax is used to. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. Use 100% of the 2025 estimated total tax. Mail this form and your check or.

Use 100% of the 2025 estimated total tax. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. The federal or irs taxes are listed. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Estimated tax is used to. Mail this form and your check or. The california tax estimator lets you calculate your state taxes for the tax year.

2024 California Estimated Tax Worksheet

Use 100% of the 2025 estimated total tax. Mail this form and your check or. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. Estimated tax is used to. The federal or irs taxes are listed.

California State Estimated Tax Payments 2025 Katherine Jackson

Estimated tax is used to. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. The california tax estimator lets you calculate your state taxes.

2021 California Estimated Tax Worksheet

The federal or irs taxes are listed. Mail this form and your check or. The california tax estimator lets you calculate your state taxes for the tax year. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

California Estimated Tax Worksheet 2023

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use 100% of the 2025 estimated total tax. The california tax estimator lets you calculate your state taxes for the tax year. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has.

2022 California Estimated Tax Worksheet

Mail this form and your check or. Estimated tax is used to. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. Use 100% of.

California Estimated Tax Worksheet 2023

The california tax estimator lets you calculate your state taxes for the tax year. Mail this form and your check or. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. Use 100% of the 2025 estimated total tax. You may have to pay estimated.

When Are California Estimated Taxes Due 2024 Berri Celeste

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. Use 100% of the 2025 estimated total tax. The california tax estimator lets you calculate your state taxes for the tax year. Mail this form and your check or. The federal or irs taxes are listed.

California Estimated Tax Worksheet 2024

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. Mail this form and your check or. The california tax estimator lets you calculate your.

Kansas Estimated Tax Form 2023 Printable Forms Free Online

The federal or irs taxes are listed. Estimated tax is used to. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. Mail this form and your check or. You may have to pay estimated tax if you receive income such as dividends, interest, capital.

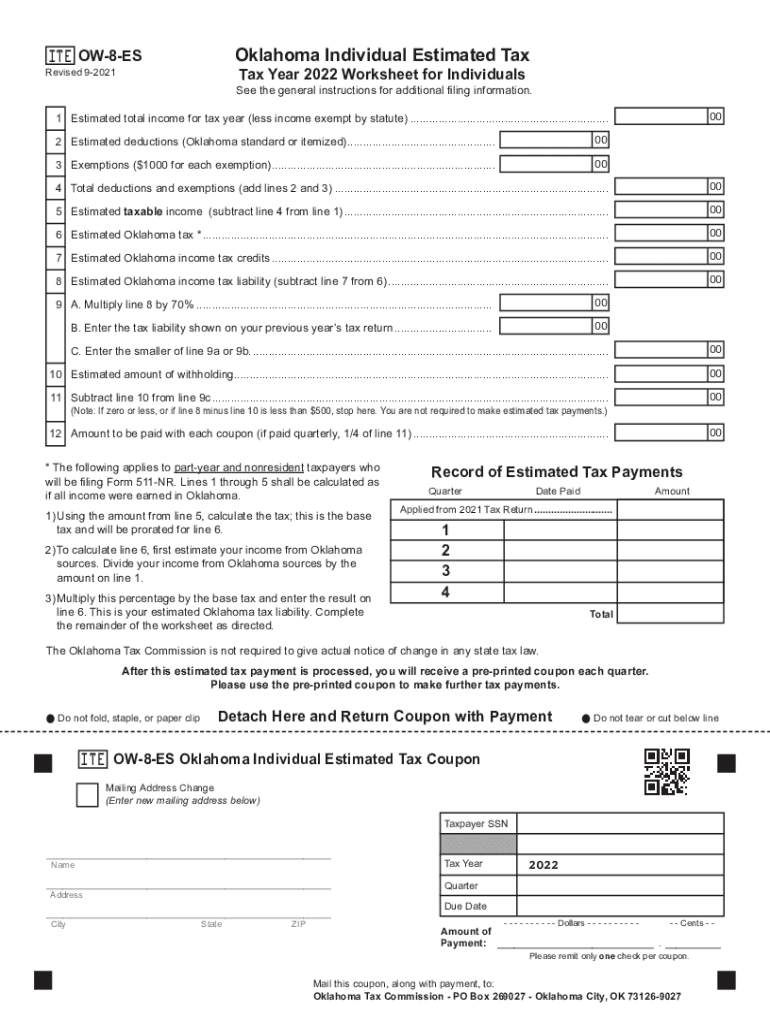

Oklahoma Estimated Tax 20222024 Form Fill Out and Sign Printable PDF

You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties. The federal or irs taxes are listed. Mail this form and your check or. Estimated tax is used to. The california tax estimator lets you calculate your state taxes for the tax year.

The California Tax Estimator Lets You Calculate Your State Taxes For The Tax Year.

Mail this form and your check or. The federal or irs taxes are listed. For state quarterly estimated tax payments you may have made in lines 1 thru 4,, the state has to be identified next to the $$. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rents, and royalties.

Use 100% Of The 2025 Estimated Total Tax.

Estimated tax is used to.